THIRD QUARTER 2025 EARNINGS CALL PRESENTATION

Published on November 14, 2025

Exhibit 99.2

Third Quarter 2025 Earnings Presentation NOVEMBER 14, 2025

This presentation has been prepared by ETHZilla Corporation (“ETHZilla” or the “Company”) solely for information purposes. The Company is making this presentation available in connection with an update on its business operations and strategies. This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company. Certain information contained in this presentation was obtained from various sources, including third parties, none of which has been commissioned and certain of which have not been independently verified. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, correctness or reasonableness of the information or the sources presented or contained herein. Unless otherwise set forth herein, this presentation speaks as of November 14, 2025. The information presented or contained in this presentation is subject to change without notice. Neither the delivery of this presentation nor any further discussions of the Company or any of its affiliates, shareholders, controlling persons, directors, officers, employees, agents, advisors or representatives with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since that date. This presentation contains statements that constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable securities laws. All statements other than statements of historical fact are forward - looking statements. These statements can be recognized by the use of words such as “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “should,” “would,” “may,” “plan,” “seek”, “will,” “look,” “future,” “assume,” “continue,” or the negative of such terms or other variations thereof, or words of similar substance or meaning. Such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in the forward - looking statements as a result of various factors and assumptions, that could cause actual results to differ materially from those contained in any forward - looking statement and which are inherently subject to significant uncertainties and contingencies that are or may be difficult or impossible to predict and are or may be beyond our control. The Company and its affiliates, shareholders, controlling persons, directors, officers, employees, agents, advisors and representatives assume no obligation to and do not undertake to update such forward - looking statements to reflect future events or circumstances, except as required by law. ETHZilla’s business is subject to substantial risks and uncertainties, including, among others: the possibility that proposed transactions may not be completed; failure to achieve anticipated benefits from stock repurchases, private placements, convertible notes, or digital asset strategies; fluctuations in ETH and other cryptocurrency prices affecting financial reporting; regulatory and legal uncertainties relating to cryptocurrencies, risks associated with outstanding debt, including convertible notes and OTC facilities; potential dilution from future financings or ATM offerings; operational and competitive risks; potential litigation; geopolitical, economic, and market conditions; and tax and accounting uncertainties, including GAAP fair value adjustments and potential impairment charges on crypto assets. Investors are cautioned not to place undue reliance on forward - looking statements. For a more complete discussion, see the “Forward - Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Form 10 - K for the year ended December 31, 2024, Form 10 - Q for the quarter ended September 30, 2025, and other SEC filings, including future Form 10 - Qs, Form 10 - Ks and Form 8 - Ks, all of which are filed with the SEC and available at www.sec.gov . All trademarks, service marks, and trade names of any party of their respective affiliates used herein are trademarks, service marks, or registered trade names of such party or its respective affiliate, respectively, as noted herein. Any other product, company names, or logos mentioned herein agree the trademark and/or intellectual property of their respective owners, and their use is not alone intended to, and does not alone imply, a relationship with any party, or an endorsement or sponsorship by or of any party. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that any party of the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable owner or licensor to these trademarks, service marks and trade names. Actual results may vary greatly from any assumptions or models built in reliance on this presentation. Results may vary due to market conditions, unforeseen circumstances, competition, an unforeseen change in how regulators in the USA or elsewhere categorize ETH, and results are subject to a multitude of risks, uncertainties, and changes. Those include but are not limited to, market conditions, the regulatory landscape defining the particular digital asset, the value of ETH, the ongoing security of the Ethereum ecosystem, technical and custodial risks, and other risks of loss. The financial projections (the “Projections”) included herein were prepared by ETHZilla in good faith using assumptions believed to be reasonable. A significant number of assumptions about the operations of the business of ETHZilla were based, in part, on economic, competitive, and general business conditions prevailing at the time the Projections were developed. Any future changes in these conditions, may materially impact the ability of ETHZilla to achieve the financial results set forth in the Projections. The Projections are based on numerous assumptions, including realization of the operating strategy of ETHZilla; industry performance; no material adverse changes in applicable legislation or regulations, or the administration thereof, or generally accepted accounting principles; general business and economic conditions; competition; retention of key management and other key employees; absence of material contingent or unliquidated litigation, indemnity, or other claims; minimal changes in current ETH pricing; no significant increases in interest rates or inflation; and other matters, many of which will be beyond the control of ETHZilla, and some or all of which may not materialize. Additionally, to the extent that the assumptions inherent in the Projections are based upon future business decisions and objectives, they are subject to change. Although the Projections are presented with numerical specificity and are based on reasonable expectations developed by ETHZilla’s management, the assumptions and estimates underlying the Projections are subject to significant business, economic, and competitive uncertainties and contingencies, many of which will be beyond the control of ETHZilla. Accordingly, the Projections are only estimates and are necessarily speculative in nature. It is expected that some or all of the assumptions in the Projections will not be realized and that actual results will vary from the Projections. Such variations may be material and may increase over time. In light of the foregoing, readers are cautioned not to place undue reliance on the Projections. The projected financial information contained herein should not be regarded as a representation or warranty by ETHZilla, its management, advisors, or any other person that the Projections can or will be achieved. ETHZilla cautions that the Projections are speculative in nature and based upon subjective decisions and assumptions. As a result, the Projections should not be relied on as necessarily predictive of actual future events. Past performance information given in this document is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance. In addition to our results calculated under generally accepted accounting principles in the United States (“GAAP”), in this presentation we also present certain non - GAAP financial measures discussed in greater detail below, and reconciled to GAAP under “Non - GAAP Financial Measures and Reconciliation” at the end of this Presentation. This presentation does not constitute an offer to sell or the solicitation of an offer to buy or acquire securities of the Company in any jurisdiction or an inducement to enter into investment activity, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever. # 2 DISCLAIMER

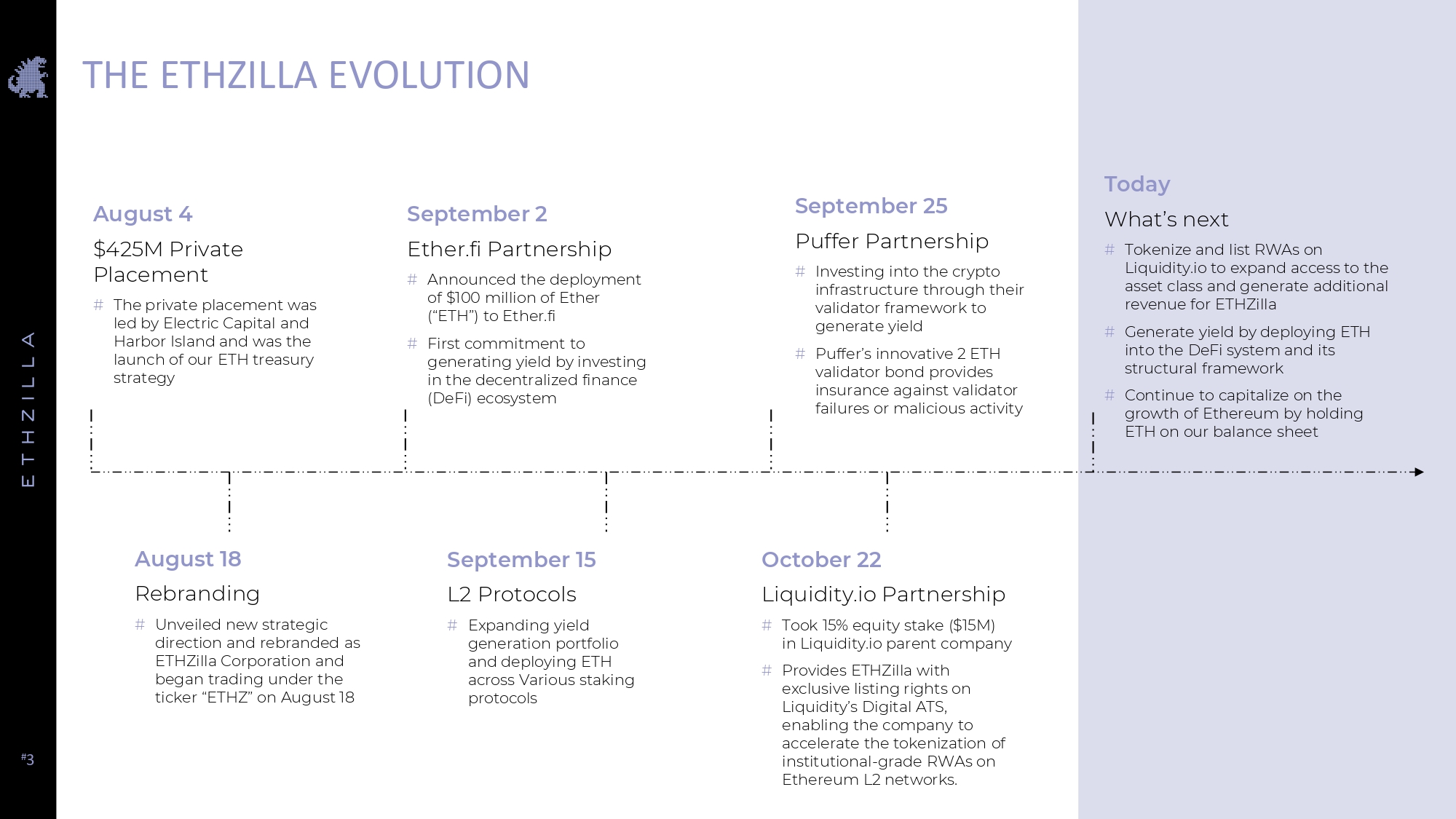

# 3 THE ETHZILLA EVOLUTION August 18 Rebranding # Unveiled new strategic direction and rebranded as ETHZilla Corporation and began trading under the ticker “ETHZ” on August 18 August 4 $425M Private Placement # The private placement was led by Electric Capital and Harbor Island and was the launch of our ETH treasury strategy September 2 Ether.fi Partnership # Announced the deployment of $100 million of Ether (“ETH”) to Ether.fi # First commitment to generating yield by investing in the decentralized finance (DeFi) ecosystem September 15 L2 Protocols # Expanding yield generation portfolio and deploying ETH across Various staking protocols September 25 Puffer Partnership # Investing into the crypto infrastructure through their validator framework to generate yield # Puffer’s innovative 2 ETH validator bond provides insurance against validator failures or malicious activity October 22 Liquidity.io Partnership # Took 15% equity stake ($15M) in Liquidity.io parent company # Provides ETHZilla with exclusive listing rights on Liquidity’s Digital ATS, enabling the company to accelerate the tokenization of institutional - grade RWAs on Ethereum L2 networks. Today What’s next # Tokenize and list RWAs on Liquidity.io to expand access to the asset class and generate additional revenue for ETHZilla # Generate yield by deploying ETH into the DeFi system and its structural framework # Continue to capitalize on the growth of Ethereum by holding ETH on our balance sheet

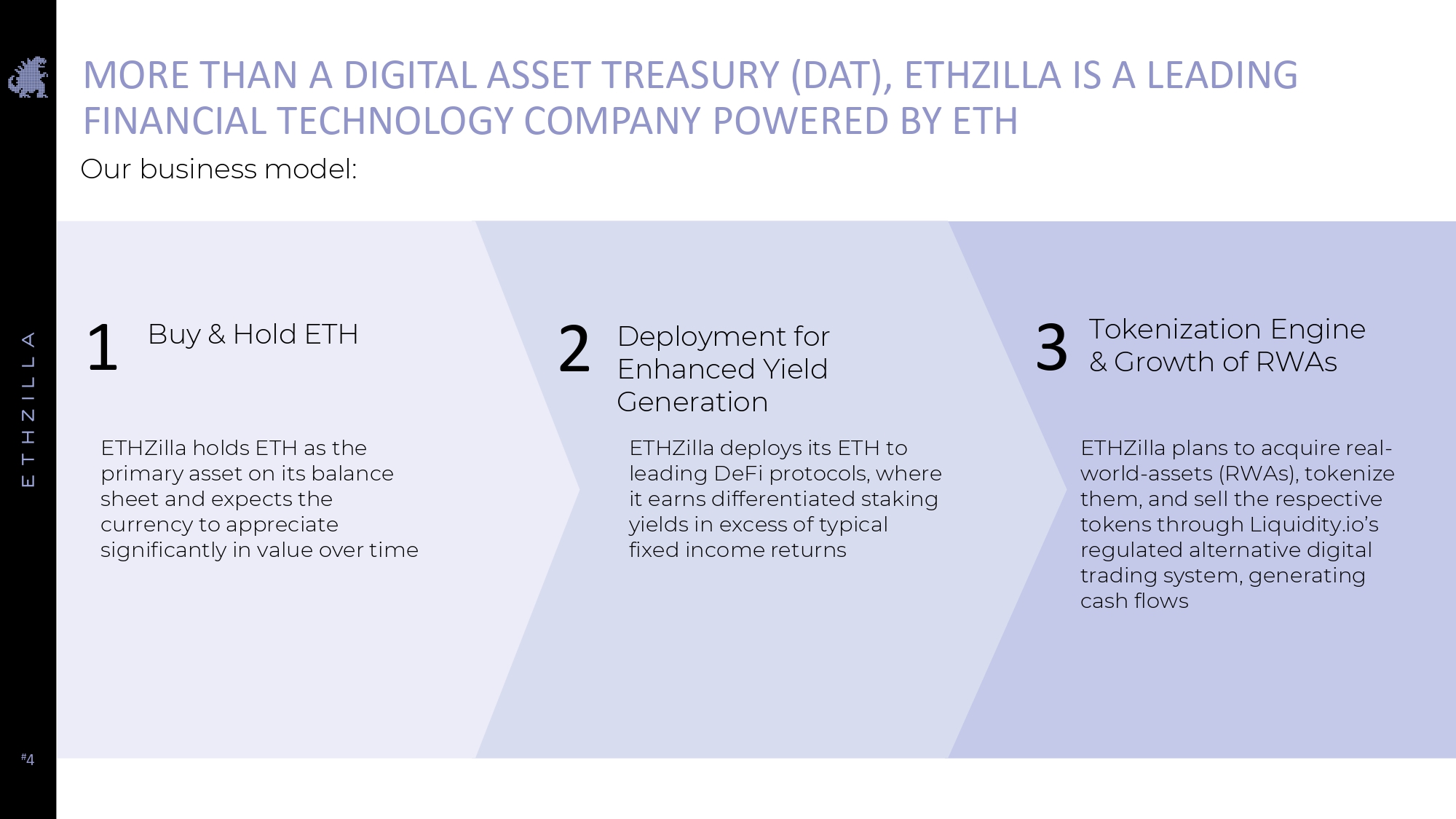

# 4 MORE THAN A DIGITAL ASSET TREASURY (DAT), ETHZILLA IS A LEADING FINANCIAL TECHNOLOGY COMPANY POWERED BY ETH Our business model: 2 ETHZilla deploys its ETH to leading DeFi protocols, where it earns differentiated staking yields in excess of typical fixed income returns ETHZilla plans to acquire real - world - assets (RWAs), tokenize them, and sell the respective tokens through Liquidity.io’s regulated alternative digital trading system, generating cash flows ETHZilla holds ETH as the primary asset on its balance sheet and expects the currency to appreciate significantly in value over time 1 3 Buy & Hold ETH Tokenization Engine & Growth of RWAs Deployment for Enhanced Yield Generation

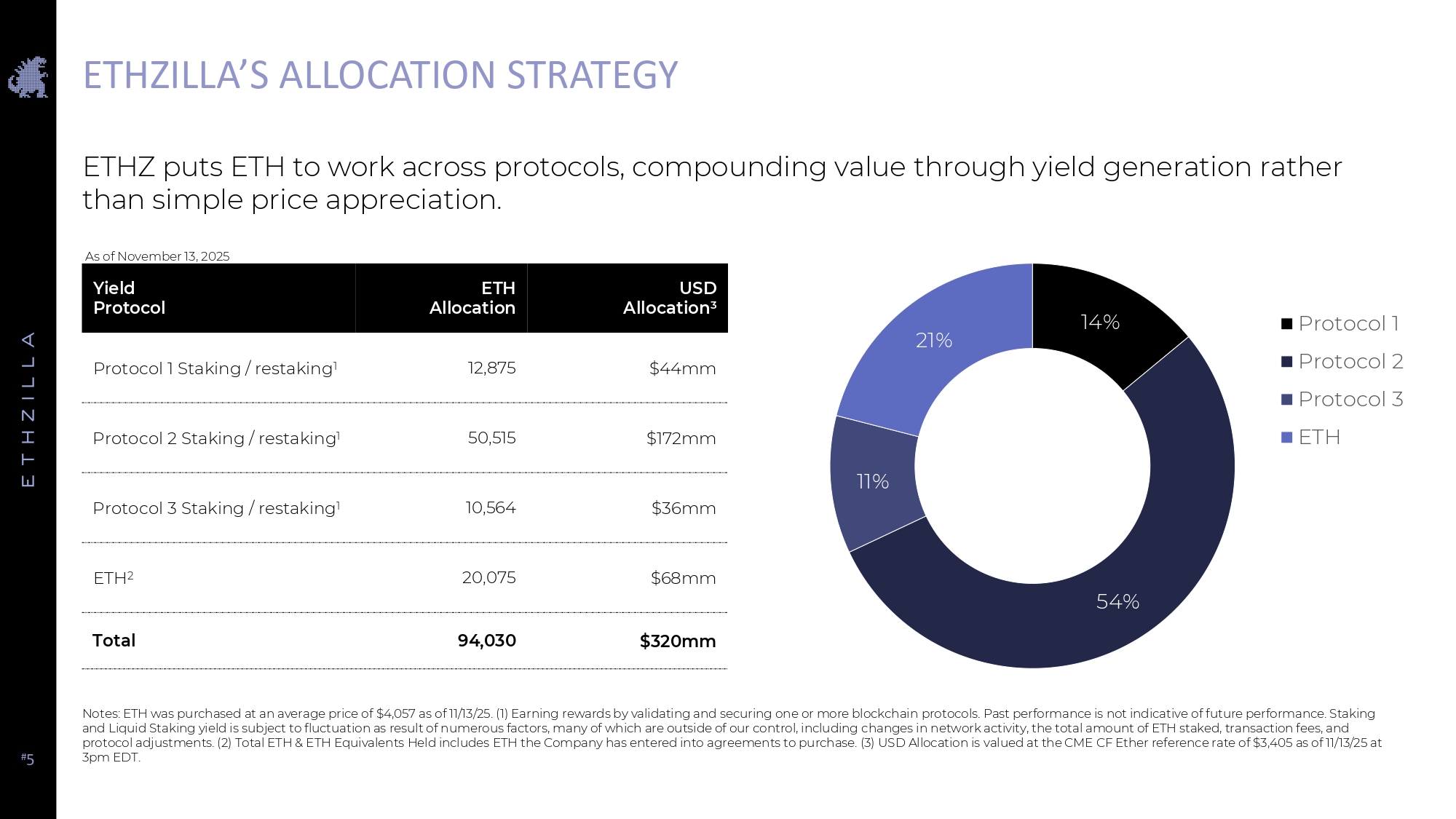

# 5 ETHZILLA’S ALLOCATION STRATEGY Notes: ETH was purchased at an average price of $4,057 as of 11/13/25. (1) Earning rewards by validating and securing one or more blockchain protocols. Past performance is not indicative of future performance. Staking and Liquid Staking yield is subject to fluctuation as result of numerous factors, many of which are outside of our control, including changes in network activity, the total amount of ETH staked, transaction fees, and protocol adjustments. (2) Total ETH & ETH Equivalents Held includes ETH the Company has entered into agreements to purchase. (3) USD Allocation is valued at the CME CF Ether reference rate of $3,405 as of 11/13/25 at 3pm EDT. ETHZ puts ETH to work across protocols, compounding value through yield generation rather than simple price appreciation. USD Allocation 3 ETH Allocation Yield Protocol $44mm 12,875 Protocol 1 Staking / restaking 1 $172mm 50,515 Protocol 2 Staking / restaking 1 $36mm 10,564 Protocol 3 Staking / restaking 1 $68mm 20,075 ETH 2 $320mm 94,030 Total 14% 54% 11% 21% Protocol 1 Protocol 2 Protocol 3 ETH As of November 13, 2025

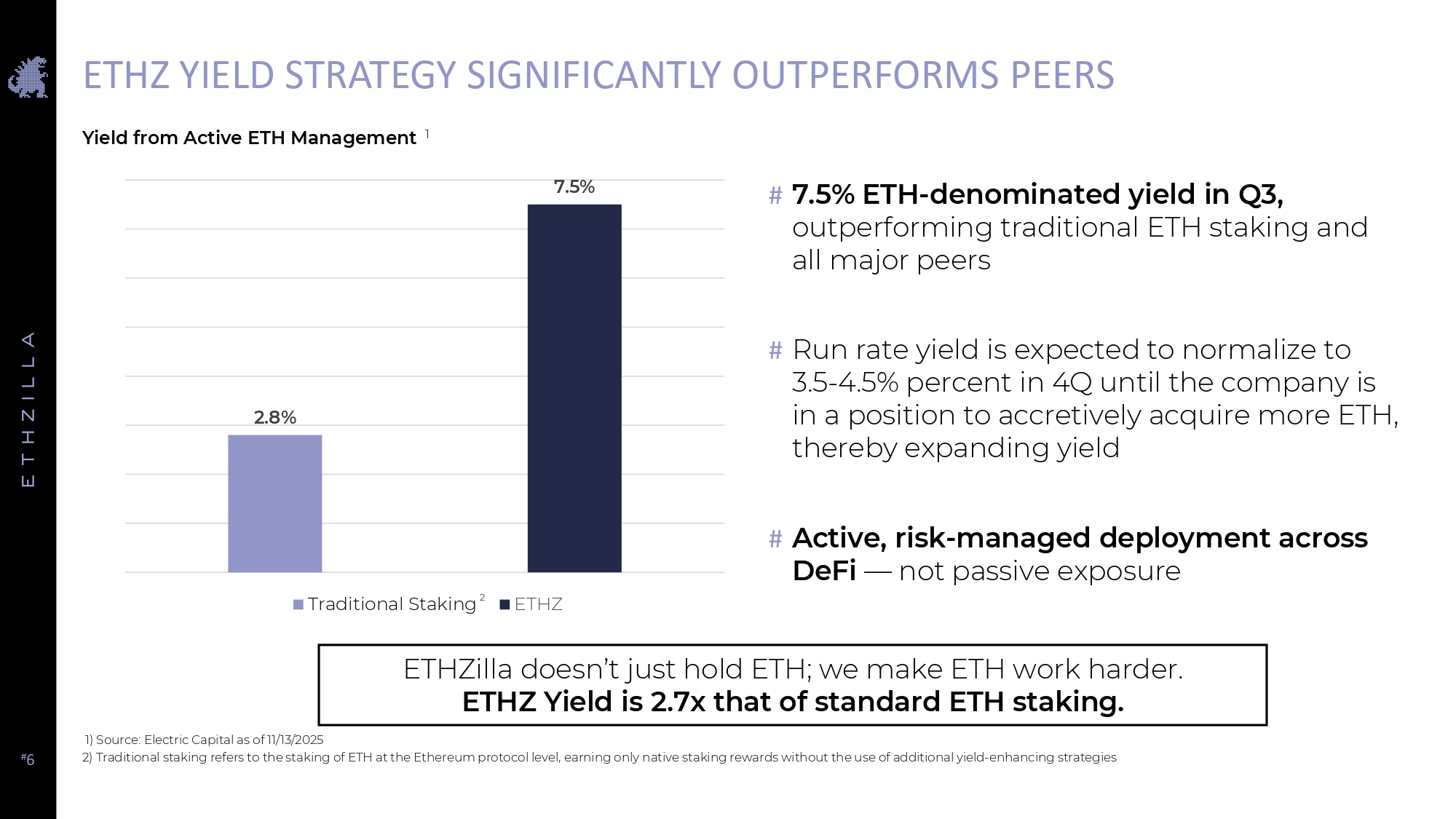

# 6 ETHZ YIELD STRATEGY SIGNIFICANTLY OUTPERFORMS PEERS 1) Source: Electric Capital as of 11/13/2025 2) Traditional staking refers to the staking of ETH at the Ethereum protocol level, earning only native staking rewards without the use of additional yield - enhancing strategies # 7.5% ETH - denominated yield in Q3, outperforming traditional ETH staking and all major peers # Run rate yield is expected to normalize to 3.5 - 4.5% percent in 4Q until the company is in a position to accretively acquire more ETH, thereby expanding yield # Active, risk - managed deployment across DeFi — not passive exposure 2.8% 7.5% Traditional Staking 2 ETHZ Yield from Active ETH Management 1 ETHZilla doesn’t just hold ETH; we make ETH work harder. ETHZ Yield is 2.7x that of standard ETH staking.

# 7 TOKENIZATION OF REAL - WORLD ASSETS (RWA) Tokenization is moving private and real - world assets on - chain, and we are seeing growing institutional adoption Growth Drivers # Global Financial Institutional adoption is accelerating + BlackRock launched BUIDL tokenized fund + Galaxy Digital launched GalaxyOne + Franklin Templeton developed Benji Technology + JPMorgan developed Kinexys Blockchain # Regulatory Clarity through U.S. GENIUS Act and EU frameworks accelerating institutional adoption and regulation # Efficiency Gains: Instant Settlement, Fractional ownership, programmable yield distribution. # DeFi Integration: Tokenized Real - World Assets on L2s will be real collateral in the ETH Ecosystem

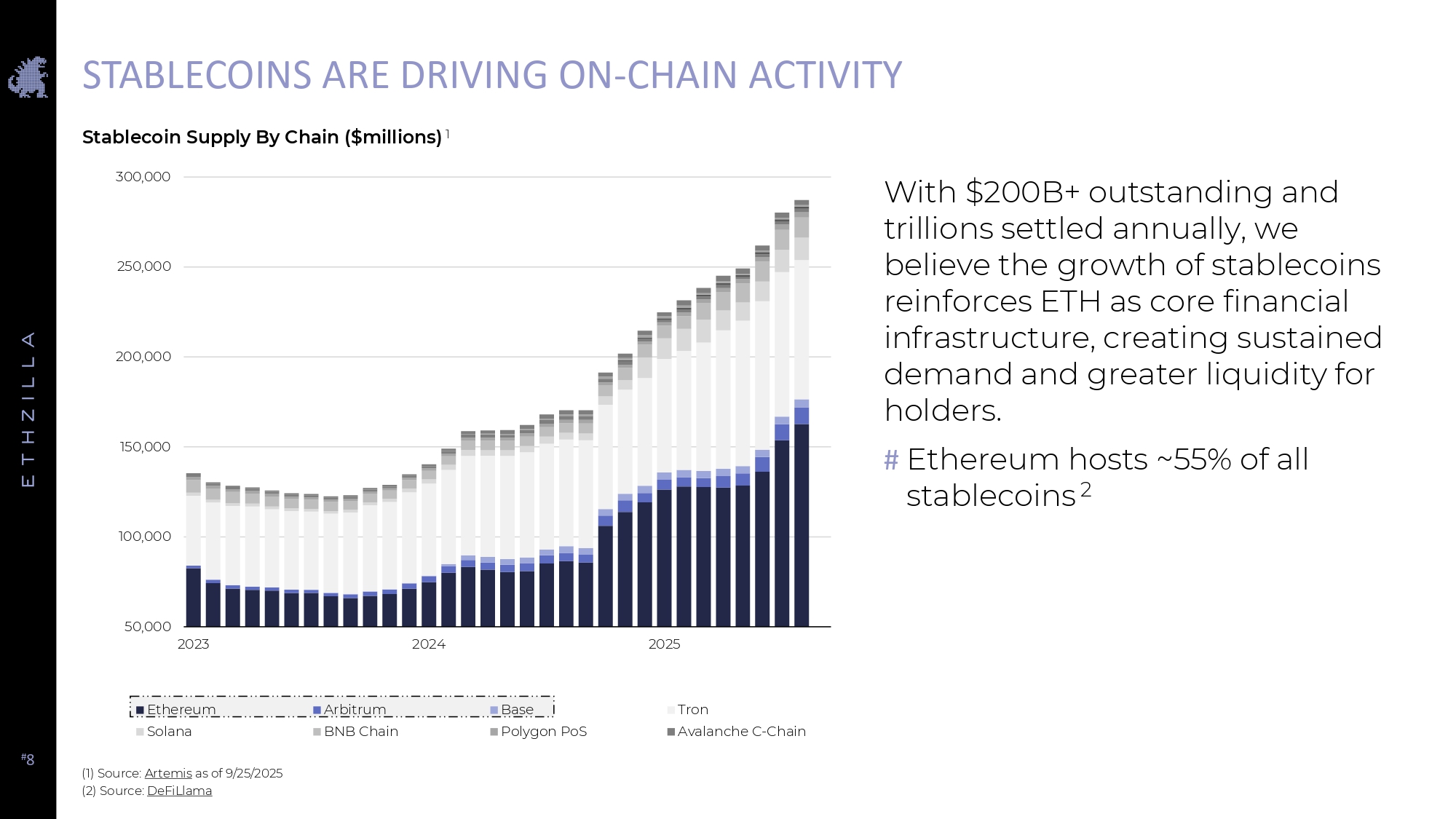

# 8 STABLECOINS ARE DRIVING ON - CHAIN ACTIVITY With $200B+ outstanding and trillions settled annually, we believe the growth of stablecoins reinforces ETH as core financial infrastructure, creating sustained demand and greater liquidity for holders. # Ethereum hosts ~55% of all stablecoins 2 Stablecoin Supply By Chain ($millions) 1 50,000 100,000 150,000 200,000 250,000 300,000 2023 2024 2025 Ethereum Arbitrum Base Tron Avalanche C - Chain Solana BNB Chain (1) Source: Artemis as of 9/25/2025 (2) Source: DeFiLlama Polygon PoS

# 9 ETHEREUM SCALES THROUGH LAYER 2’S Source: Artemis As activity grows on L2 networks like Arbitrum, Optimism, and Base, Ethereum’s role as the settlement layer is reinforced, which is expected to drive demand, deeper liquidity, and greater institutional legitimacy. Stablecoin Transfer Volume ($millions) 250,000 1,250,000 2,250,000 3,250,000 4,250,000 5,250,000 2023 2024 2025 Ethereum Arbitrum Base OP Mainnet Mantle BNB Chain Polygon PoS Stellar Celo Ripple Sui HyperEVM Sei Network TON Kaia Solana Tron Avalanche C - Chain Katana Sonic Aptos

# 10 INVESTMENT IN LIQUIDITY.IO PROVIDES FOUNDATION FOR TOKENIZATION # ETHZilla is purchased 15% of parent company of Liquidity.io at a $100mm valuation # ETHZilla invested $5mm cash & issued $10mm of restricted ETHZ common shares to parent company of Liquidity.io # ETHZilla has exclusive right to list Ethereum L2 Tokens on the Exchange # ETHZilla to take one of three board seats at parent company of Liquidity.io # Right of first refusal (ROFR) to acquire additional equity in future funding rounds Investment Terms Strategic Rationale # Secures exclusive access to a regulated exchange, accelerating ETHZilla's tokenization + compliance strategy and establishing a competitive moat # Enables ETHZilla to leverage Liquidity.io’s ATS to convert future ETHZilla - issued tokenized RWAs into compliant, tradable instruments with both primary and secondary market liquidity. # Compliance distribution engine secured, providing bank - grade KYC/KYB, onboarding, and workflow automation, accelerating onboarding and enterprise adoption.

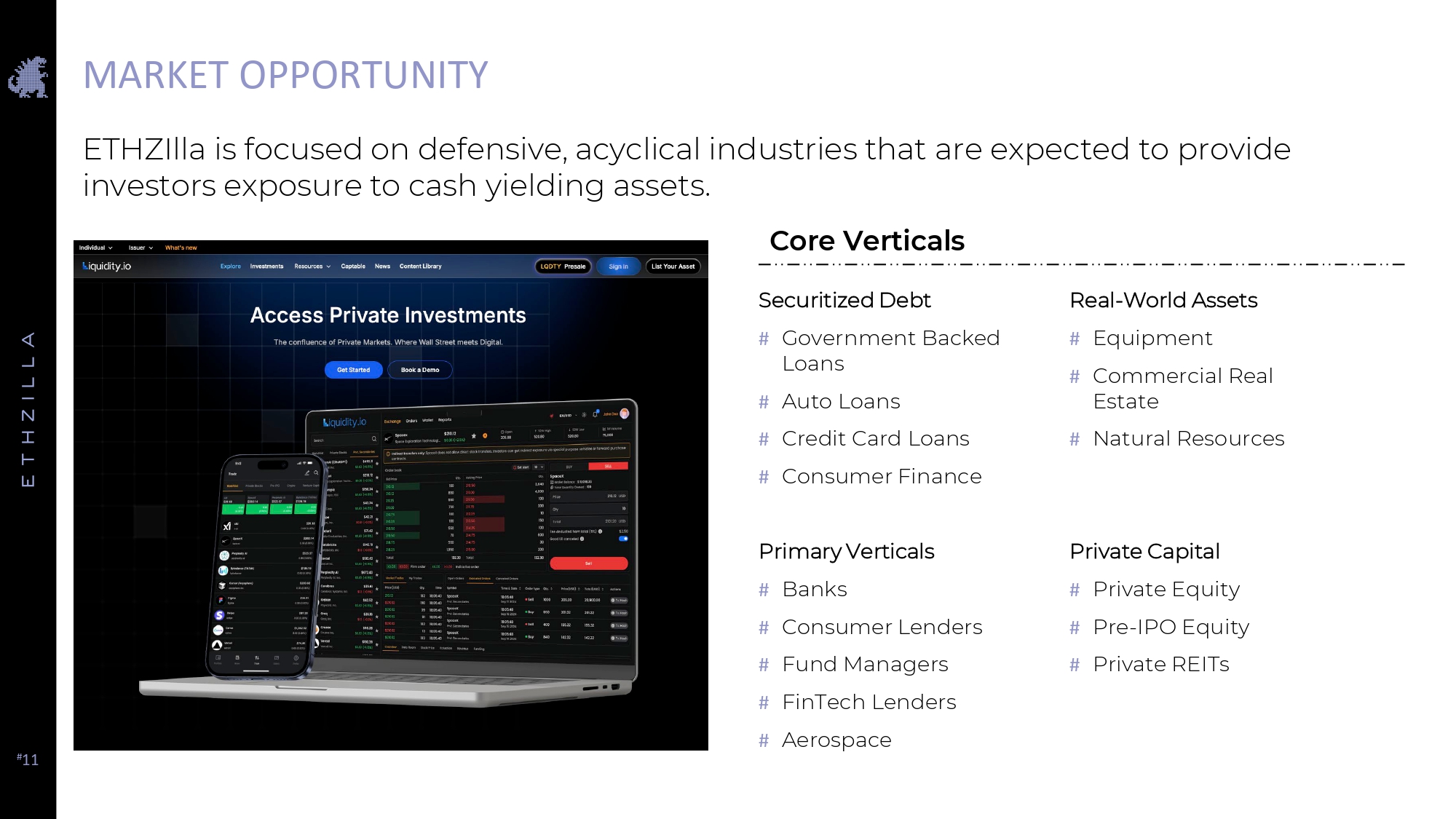

# 11 ETHZIlla is focused on defensive, acyclical industries that are expected to provide investors exposure to cash yielding assets. Core Verticals MARKET OPPORTUNITY Primary Verticals # Banks # Consumer Lenders # Fund Managers # FinTech Lenders # Aerospace Real - World Assets # Equipment # Commercial Real Estate # Natural Resources Securitized Debt # Government Backed Loans # Auto Loans # Credit Card Loans # Consumer Finance Private Capital # Private Equity # Pre - IPO Equity # Private REITs

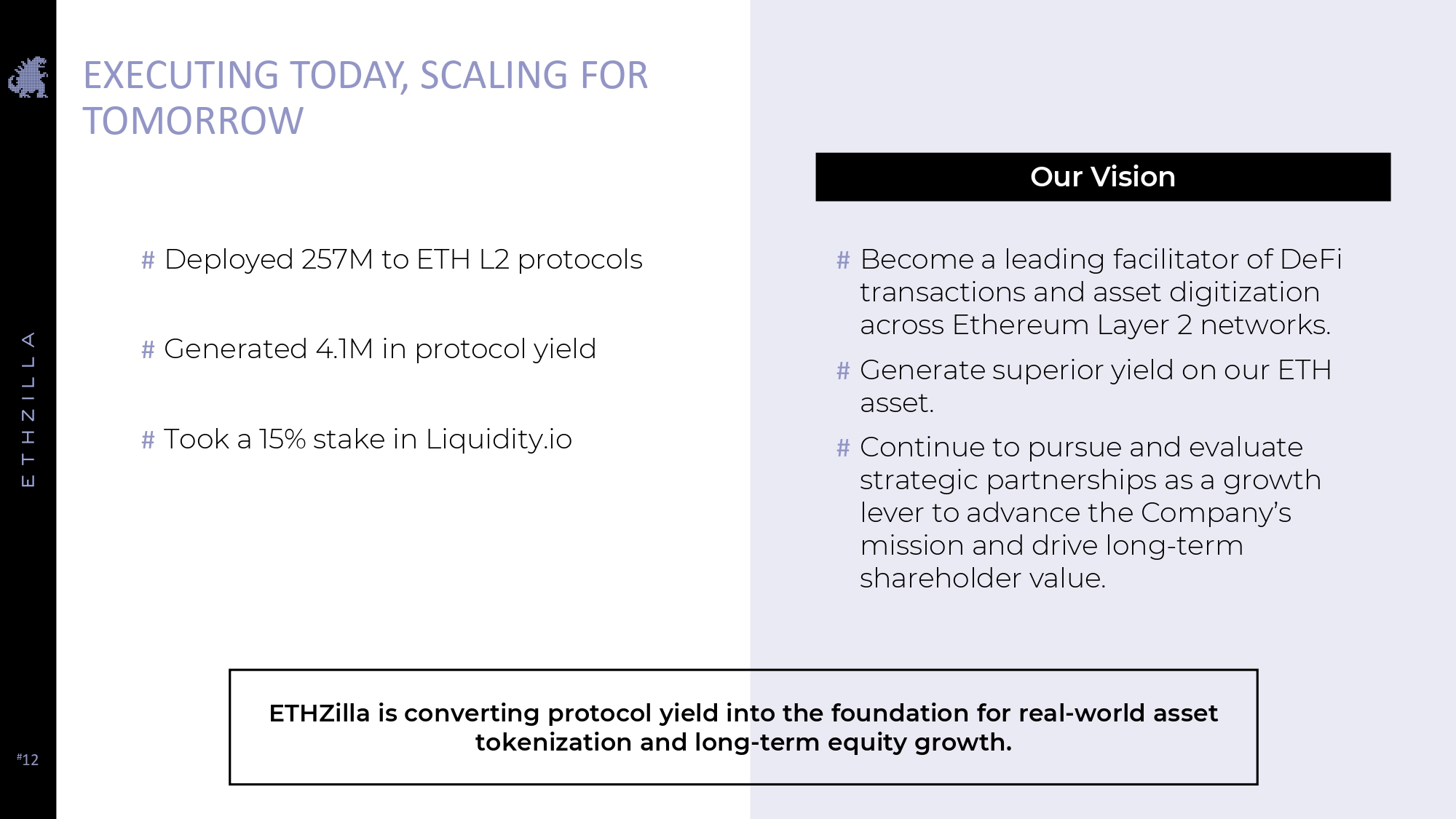

# 12 Our Vision EXECUTING TODAY, SCALING FOR TOMORROW # Deployed 257M to ETH L2 protocols # Generated 4.1M in protocol yield # Took a 15% stake in Liquidity.io # Become a leading facilitator of DeFi transactions and asset digitization across Ethereum Layer 2 networks. # Generate superior yield on our ETH asset. # Continue to pursue and evaluate strategic partnerships as a growth lever to advance the Company’s mission and drive long - term shareholder value. ETHZilla is converting protocol yield into the foundation for real - world asset tokenization and long - term equity growth.

FINANCIAL RESULTS

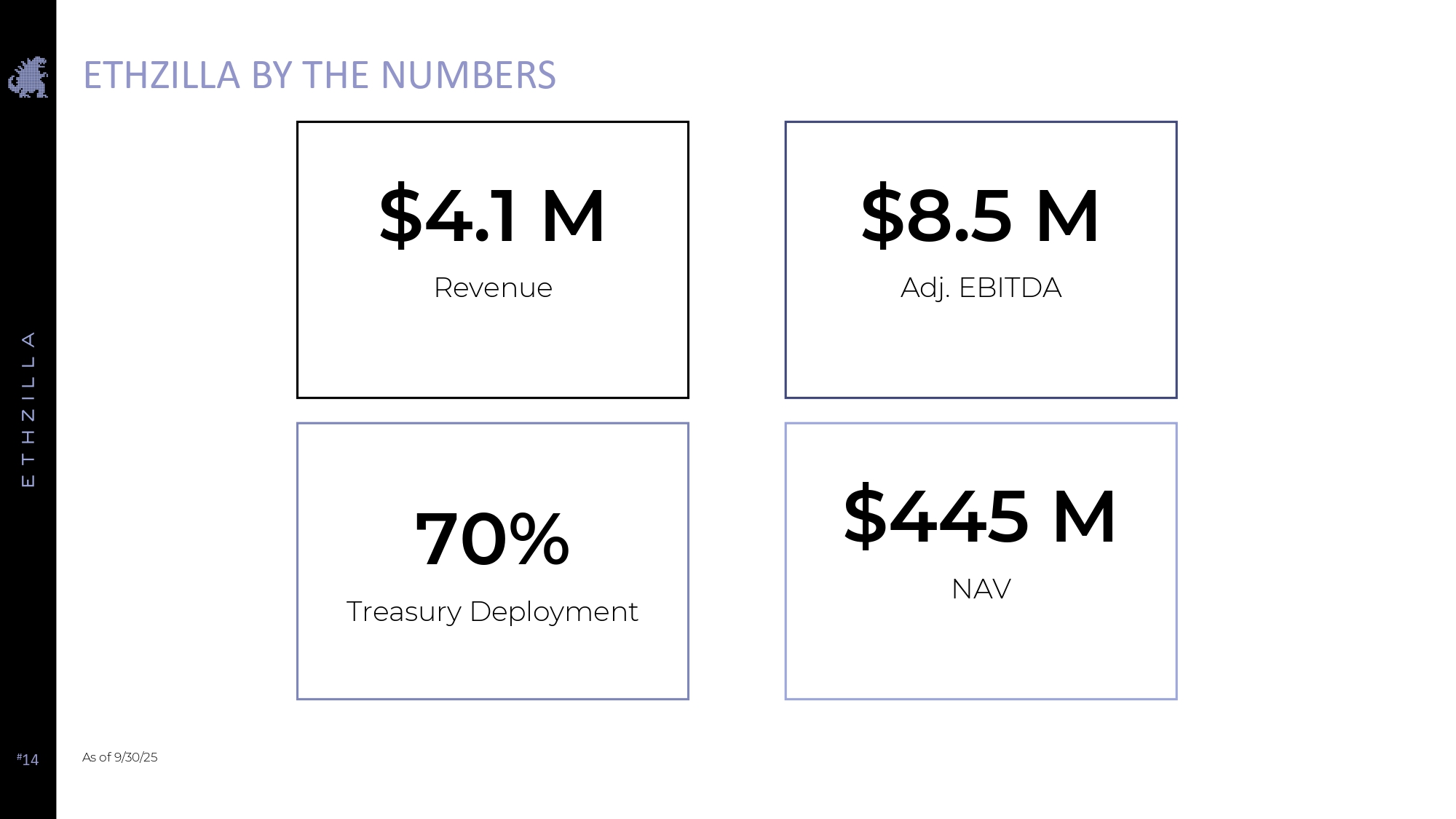

# 14 ETHZILLA BY THE NUMBERS As of 9/30/25 $4.1 M Revenue 70% Treasury Deployment $445 M NAV $8.5 M Adj. EBITDA

# 15 CONSOLIDATED INCOME STATEMENT (NON - GAAP) September 30, September 30, 2024 2025 2024 2025 $ - $ 4,110 $ - $ 4,110 Revenues - - - 4,110 - - - 4,110 Total cost of revenues Gross income 3,472 227,954 596 224,605 Selling, general and administrative expense (3,472) (223,844) (596) (220,494) Operating income (loss) (29) (320) (10.552) (320) Interest expense 1,842 12,156 74 12,143 Other income (1,659) (212,008) (532) (208,671) Income (loss) before income taxes Income tax benefit - (1,659) (212,008) (532) (208,671) Net Income (loss) from Continuing Operations (236) (8,830) (304) (8,071) Net Income (loss) from Discontinued Operations (1,895) (220,838) (837) (216,742) Net Income (loss) (82) 359 (67) 567 Other Comprehensive Income (loss) (1,976) (220,479) (904) (216,175) Total Comprehensive Loss $ (19.59) $ (47.20) $ (5.43) $ (16.80) Basic and Diluted Net Loss per Common Share - Continuing operation $ (2.79) $ (1.97) $ (3.10) $ (0.65) Basic and Diluted Net Loss per Common Share - Discontinured operation 85 4,492 98 12,418 Weighted average Common Stock outstanding – basic 85 4,492 98 12,418 Weighted average Common Stock outstanding – diluted For the nine months ended ETHZILLA CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) (unaudited) For the three months ended

# 16 In addition to its reported operating results in accordance with U.S. generally accepted accounting principles (GAAP), ETHZilla has included in this presentation certain financial measures that are considered non - GAAP financial measures, including the following: • Adjusted EBITDA • Adjusted net income Although we believe that net income or loss, as determined in accordance with U.S. Generally Accepted Accounting Principles (GAAP), is the most appropriate earnings measure, we use EBITDA and Adjusted EBITDA as key profitability measures to assess the performance of our business. We believe these measures help illustrate underlying trends in our business and we use these measures to establish budgets and operational goals, and communicate internally and externally, in managing our business and evaluating its performance. We also believe these measures help investors compare our operating performance with its results in prior periods in a way that is consistent with how management evaluates such performance. EBITDA is a non - GAAP profitability measure that represents net income or loss for the period before the impact of the interest expense, income tax expense (benefit) and depreciation and amortization of property, plant and equipment and intangible assets . EBITDA eliminates potential differences in performance caused by variations in capital structures (affecting financing expenses), the cost and age of tangible assets (affecting relative depreciation expense) and the extent to which intangible assets are identifiable (affecting relative amortization expense) . Adjusted EBITDA is a non - GAAP profitability measure that represents EBITDA before certain items that are considered to hinder comparison of the performance of our businesses on a period - over - period basis or with other businesses. During the periods presented, we exclude from Adjusted EBITDA certain costs that are required to be expensed in accordance with GAAP, including non - cash stock - based compensation, business development and integration expenses, offering costs, non - cash adjustments to the fair value of earnout consideration, and non - cash adjustments to the fair value of outstanding warrants. Our management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA are appropriate to provide additional information to investors about certain material non - cash items and about unusual items that we do not expect to continue at the same level in the future. Each of the profitability measures described below are not recognized under GAAP and do not purport to be an alternative to net income or loss determined in accordance with GAAP as a measure of our performance. Such measures have limitations as analytical tools, and should not be considered in isolation or as substitutes for our results as reported under GAAP. EBITDA and Adjusted EBITDA exclude items that can have a significant effect on our profit or loss and should, therefore, be used only in conjunction with our GAAP profit or loss for the period. Our management compensates for the limitations of using non - GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, these measures may not be comparable to other similarly titled measures of other companies. EBITDA and Adjusted EBITDA are unaudited, and have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations are: EBITDA and Adjusted EBITDA do not reflect cash expenditures, or future or contractual commitments; EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, capital expenditures or working capital needs; EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt or cash income tax payments; although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. In addition, other companies in this industry may calculate EBITDA and Adjusted EBITDA differently than the Company does, limiting its usefulness as a comparative measure. The Company’s presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or nonrecurring items. We compensate for these limitations by providing a reconciliation of each of these non - GAAP measures to the most comparable GAAP measure. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non - GAAP measures in conjunction with the most directly comparable GAAP financial measure. For more information on these non - GAAP financial measures, please see the below reconciliation of these non - GAAP financial measures to their GAAP counterparts, below under “Unaudited Reconciliation of EBIDTA and Adjusted EBITDA to Net loss”, at the end of this release. NON - GAAP FINANCIAL MEASURES AND RECONCILIATIONS

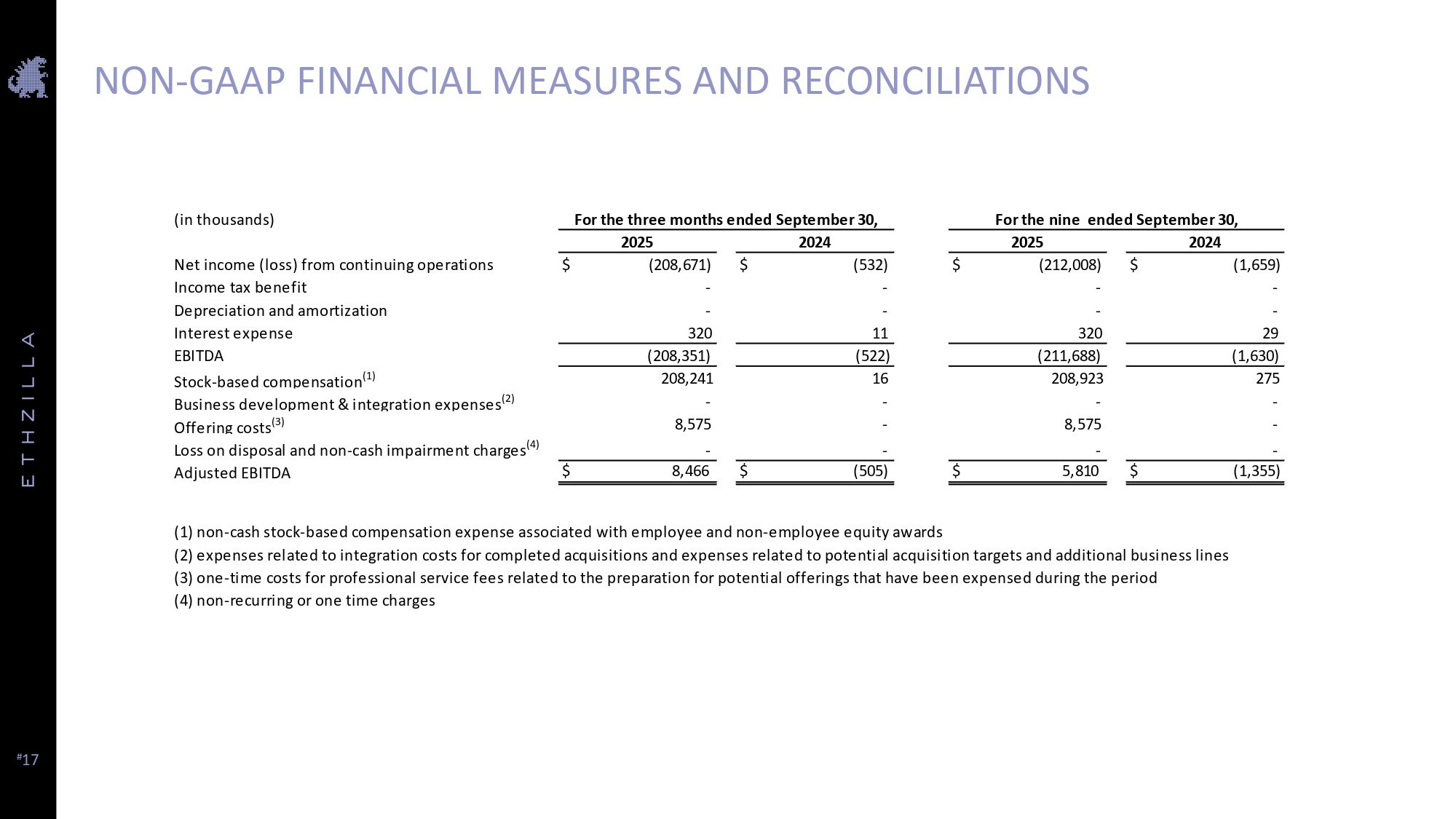

# 17 NON - GAAP FINANCIAL MEASURES AND RECONCILIATIONS (in thousands) 2024 2025 2024 2025 $ (1,659) $ (212,008) $ (532) $ (208,671) Net income (loss) from continuing operations - - - - Income tax benefit - - - - Depreciation and amortization 29 320 11 320 Interest expense (1,630) (211,688) (522) (208,351) EBITDA 275 208,923 16 208,241 Stock - based compensation (1) - - - - Business development & integration expenses (2) - 8,575 - 8,575 Offering costs (3) - - - - Loss on disposal and non - cash impairment charges (4) $ (1,355) $ 5,810 $ (505) $ 8,466 Adjusted EBITDA (1) non - cash stock - based compensation expense associated with employee and non - employee equity awards (2) expenses related to integration costs for completed acquisitions and expenses related to potential acquisition targets and additional business lines (3) one - time costs for professional service fees related to the preparation for potential offerings that have been expensed during the period (4) non - recurring or one time charges For the three months ended September 30, For the nine ended September 30,

# 18 DISCIPLINED CAPITAL ALLOCATION DRIVING SHAREHOLDER VALUE Deploying ETH to generate on - chain cash flows Building the RWA tokenization platform Returning capital via share repurchases $257M deployed across EtherFi and Puffer to generate recurring on - chain cash flows and support expansion of tokenization infrastructure. $15M strategic investment for 15% stake in Liquidity.io to integrate ETHZilla infrastructure with a regulated broker - dealer to enable compliant RWA trading on - chain. Sold ~$37M of ETH to repurchase ~1.45M shares in the open market under the $250M buyback program.

# 19 FOURTH QUARTER OUTLOOK # The Company expects revenue - generating RWAs on chain in the coming weeks. # The Company anticipates positive adjusted EBITDA in the fourth quarter. # L 2 protocol yield is expected to range between 3 . 5 % and 4 . 5 % in the fourth quarter, supported by continued deployment across leading restaking protocols . # The Company plans to continue opportunistically repurchasing shares below NAV, using the remaining proceeds of its ETH sale when accretive, under its existing board authorized $ 250 million stock repurchase program .

THANK YOU i r.ethzilla.com LinkedIn @ ETHZilla_ETHZ ir@ethzilla.com