PRESENTATION DATED OCTOBER 29, 2025

Published on October 29, 2025

Exhibit 99.1

THINKEQUITY CONFERENCE 2025 OCTOBER 30, 2025

# 2 DISCLAIMER This presentation has been prepared by ETHZilla Corporation (“ETHZilla” or the “Company”) solely for information purposes . This presentation does not constitute an offer to sell or the solicitation of an offer to buy or acquire securities of the Company in any jurisdiction or an inducement to enter into investment activity, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever . Specifically, this presentation does not constitute a “prospectus” within the meaning of the U . S . Securities Act of 1933 , as amended (the “Securities Act”) . Current and prospective investors are encouraged to conduct their own analysis and review of information contained in this presentation as well as important additional information through the United States Securities and Exchange Commission (the “SEC”) EDGAR system at www . sec . gov and on our website at www . ethzilla . com . The Company is making this presentation available in connection with an update on its business operations and strategies . This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company . No securities of the Company may be offered or sold in the United States without registration with the SEC or an exemption from such registration pursuant to the Securities Act and the rules and regulations thereunder . Certain information contained in this presentation was obtained from various sources, including third parties, and has not been independently verified . No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness, correctness or reasonableness of the information or the sources presented or contained herein . By receiving this presentation, you acknowledge and agree that none of the Company or any of its affiliates, shareholders, controlling persons, directors, officers, employees, agents, advisors or representatives will be liable (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with the presentation . This presentation speaks as of September 30 , 2025 . The information presented or contained in this presentation is subject to change without notice . Neither the delivery of this presentation nor any further discussions of the Company or any of its affiliates, shareholders, controlling persons, directors, officers, employees, agents, advisors or representatives with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since that date . This presentation contains statements that constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable securities laws . All statements other than statements of historical fact are forward - looking statements, including, but not limited to, statements regarding the Company's future financial position, business strategy, budgets, projected costs, and plans and objectives of management for future operations . These statements refer to many things, including and not limited to, the future value of any digital asset and/or another cryptocurrency, the management of a sophisticated cryptocurrency treasury strategy, including its participation in DeFi protocols, and future performance, and all other statements that are not historical facts, or that are intended to be forward looking statements, should be read as forward looking statements . There are risks associated with the contemplated transactions, including regulatory and legal uncertainty, risks of loss associated with the industry, line of business, trade, customers, partners, custodians, and vendors of the Company, and other risks . Historical facts are presented without intent to persuade . These statements can be recognized by the use of words such as “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “should,” “would,” “may,” “plan,” “seek”, “will,” “look,” “future,” “assume,” “continue,” or the negative of such terms or other variations thereof, or words of similar substance or meaning . Such forward - looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in the forward - looking statements as a result of various factors and assumptions, that could cause actual results to differ materially from those contained in any forward - looking statement and which are inherently subject to significant uncertainties and contingencies that are or may be difficult or impossible to predict and are or may be beyond our control . The Company and its affiliates, shareholders, controlling persons, directors, officers, employees, agents, advisors and representatives assume no obligation to and do not undertake to update such forward - looking statements to reflect future events or circumstances . All trademarks, service marks, and trade names of any party of their respective affiliates used herein are trademarks, service marks, or registered trade names of such party or its respective affiliate, respectively, as noted herein . Any other product, company names, or logos mentioned herein agree the trademark and/or intellectual property of their respective owners, and their use is not alone intended to, and does not alone imply, a relationship with any party, or an endorsement or sponsorship by or of any party . Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that any party of the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable owner or licensor to these trademarks, service marks and trade names . Actual results may vary greatly from any assumptions or models built in reliance on this presentation . Results may vary due to market conditions, unforeseen circumstances, competition, an unforeseen change in how regulators in the USA or elsewhere categorize ETH, and results are subject to a multitude of risks, uncertainties, and changes . Those include but are not limited to, market conditions, the regulatory landscape defining the particular digital asset, the value of ETH, the ongoing security of the Ethereum ecosystem, technical and custodial risks, and other risks of loss . Recipients of this presentation must not construe anything contained herein as constituting financial, investment, legal, tax or other advice of any kind . Recipients should seek advice from their own advisors as to these matters . For a description of the risks relating to an investment in the Company, we refer you to the “Forward - Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including Form 10 - Qs, Form 10 - Ks and Form 8 - Ks, filed with the SEC available at www . sec . gov .

BORN FROM ETHEREUM . BUILT FOR EVERYONE .

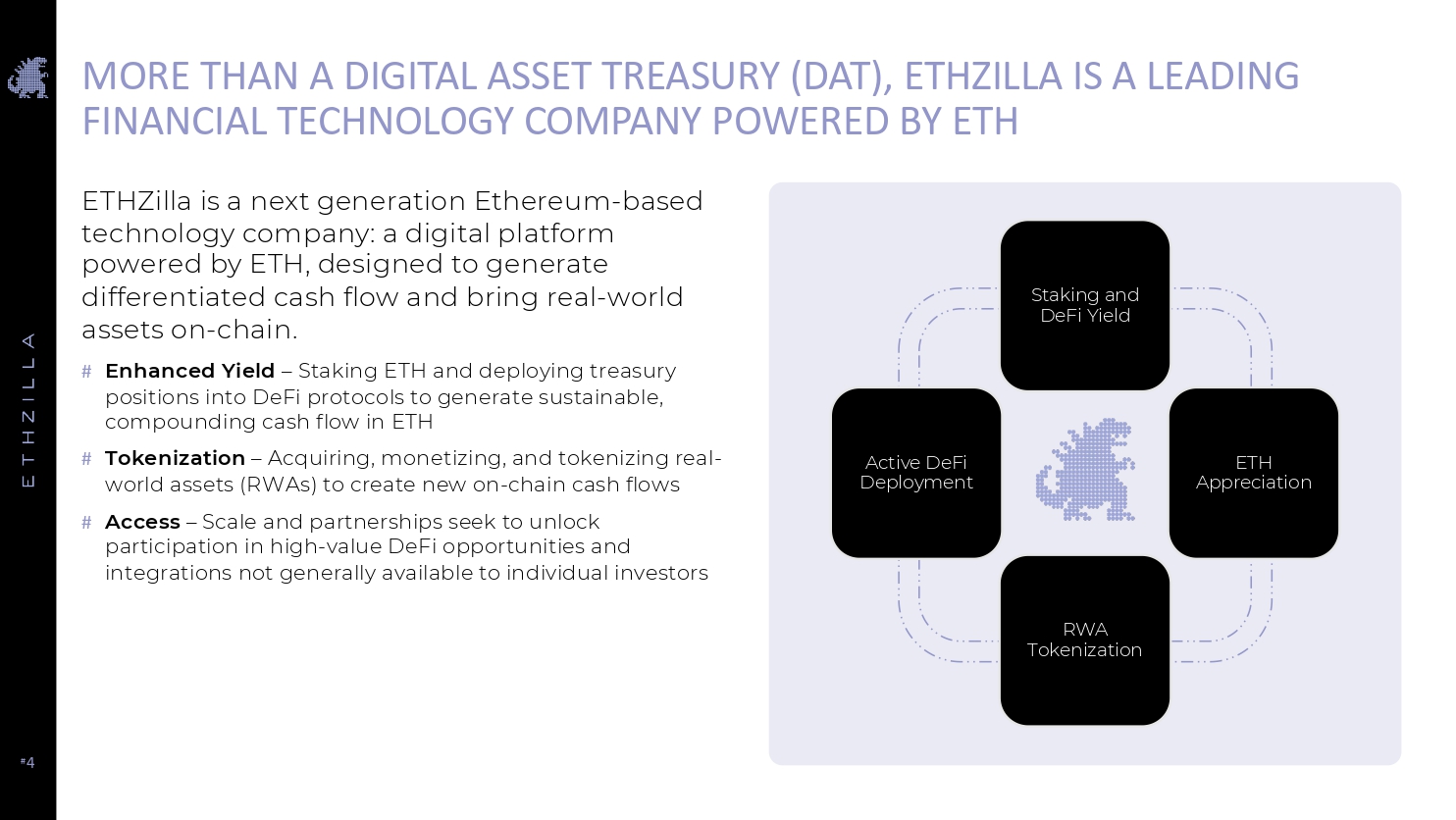

# 4 MORE THAN A DIGITAL ASSET TREASURY (DAT), ETHZILLA IS A LEADING FINANCIAL TECHNOLOGY COMPANY POWERED BY ETH ETHZilla is a next generation Ethereum - based technology company: a digital platform powered by ETH, designed to generate differentiated cash flow and bring real - world assets on - chain. # Enhanced Yield – Staking ETH and deploying treasury positions into DeFi protocols to generate sustainable, compounding cash flow in ETH # Tokenization – Acquiring, monetizing, and tokenizing real - world assets (RWAs) to create new on - chain cash flows # Access – Scale and partnerships seek to unlock participation in high - value DeFi opportunities and integrations not generally available to individual investors Staking and DeFi Yield RWA Tokenization ETH Appreciation Active DeFi Deployment

# 5 OUR MODEL What we do: 2 ETHZilla deploys its ETH to leading DeFi protocols, where it earns differentiated staking yields in excess of typical fixed income returns 3 ETHZilla plans to acquire real - world - assets (RWAs), tokenize them, and sell the respective tokens through Liquidity.io’s regulated alternative digital trading system, generating cash flows ETHZilla holds ETH as the primary asset on its balance sheet and expects the currency to appreciate significantly in value over time 1 Buy & Hold ETH Tokenization Engine & Growth of RWAs Deployment for Yield Generation

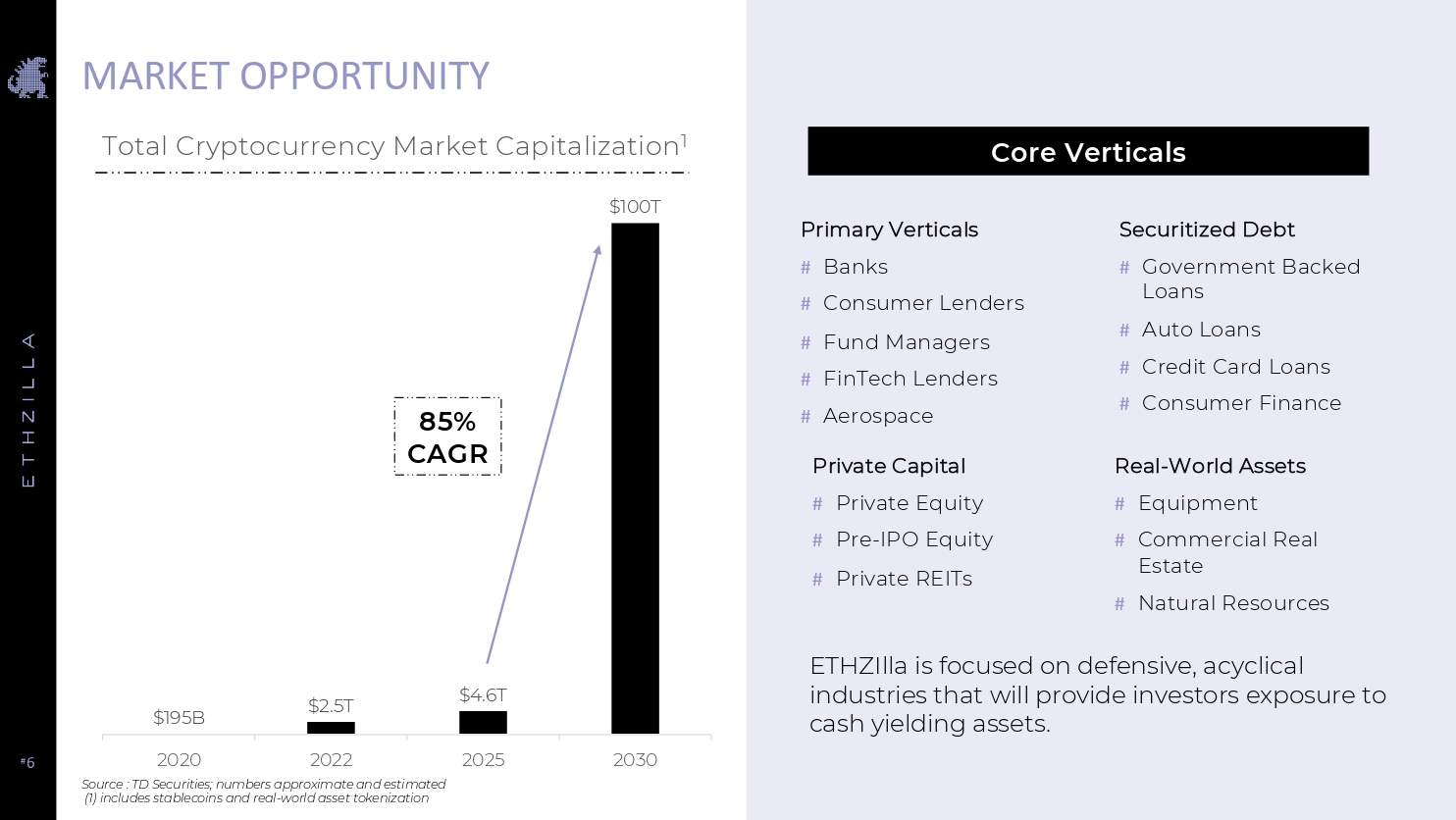

# 6 Core Verticals ETHZIlla is focused on defensive, acyclical industries that will provide investors exposure to cash yielding assets. MARKET OPPORTUNITY $195B $2.5T $4.6T $100T 2020 2022 2025 2030 85% CAGR Primary Verticals # Banks # Consumer Lenders # Fund Managers # FinTech Lenders # Aerospace Real - World Assets # Equipment # Commercial Real Estate # Natural Resources Securitized Debt # Government Backed Loans # Auto Loans # Credit Card Loans # Consumer Finance Private Capital # Private Equity # Pre - IPO Equity # Private REITs Source : TD Securities; numbers approximate and estimated (1) includes stablecoins and real - world asset tokenization Total Cryptocurrency Market Capitalization 1

ETHEREUM UNDERPINS OUR STRATEGY

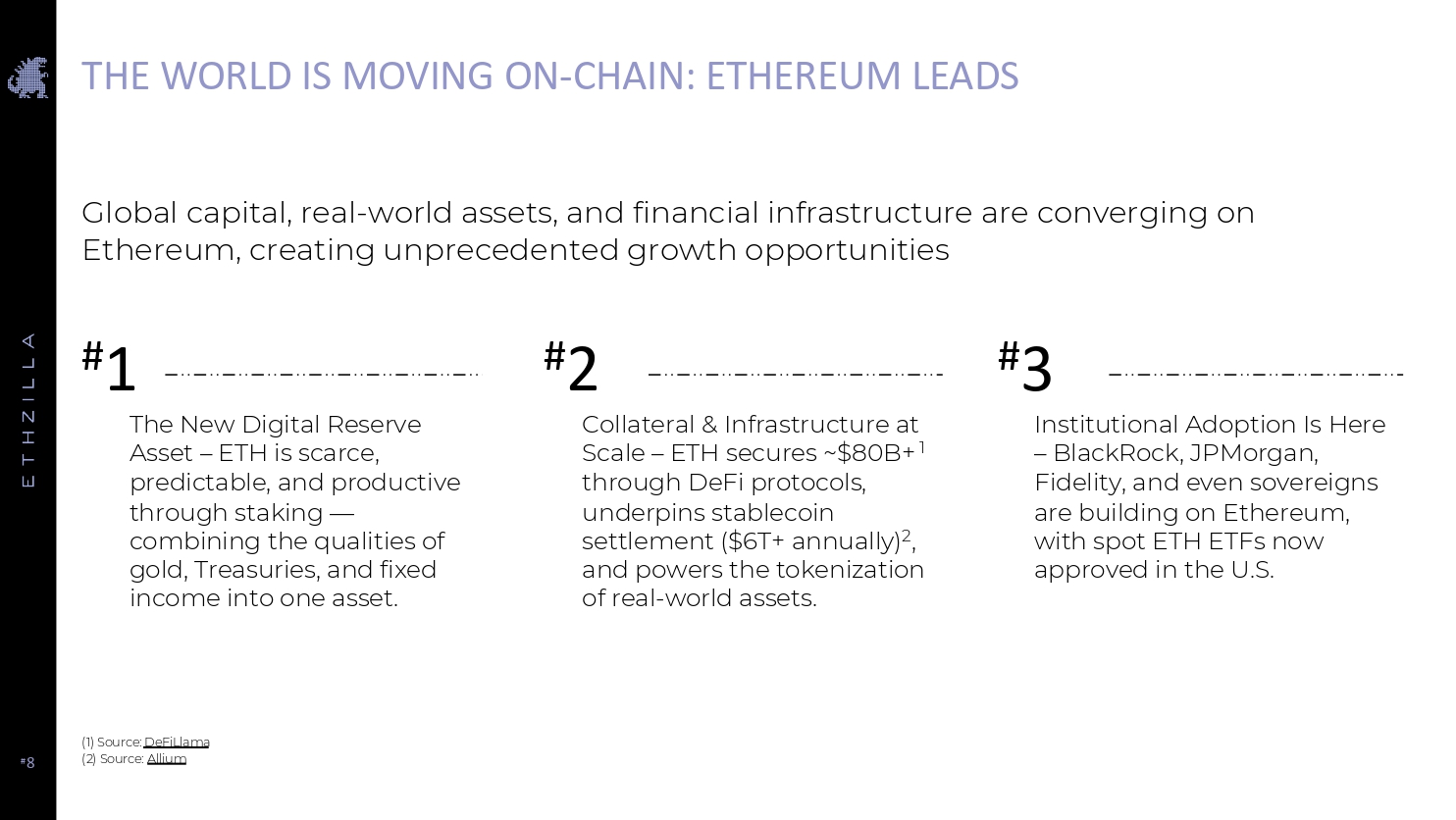

# 8 THE WORLD IS MOVING ON - CHAIN: ETHEREUM LEADS The New Digital Reserve Asset – ETH is scarce, predictable, and productive through staking — combining the qualities of gold, Treasuries, and fixed income into one asset. Collateral & Infrastructure at Scale – ETH secures ~$80B+ 1 through DeFi protocols, underpins stablecoin settlement ($6T+ annually) 2 , and powers the tokenization of real - world assets. Institutional Adoption Is Here – BlackRock, JPMorgan, Fidelity, and even sovereigns are building on Ethereum, with spot ETH ETFs now approved in the U.S. Global capital, real - world assets, and financial infrastructure are converging on Ethereum, creating unprecedented growth opportunities (1) Source: DeFiLlama (2) Source: Allium # 1 # 2 # 3

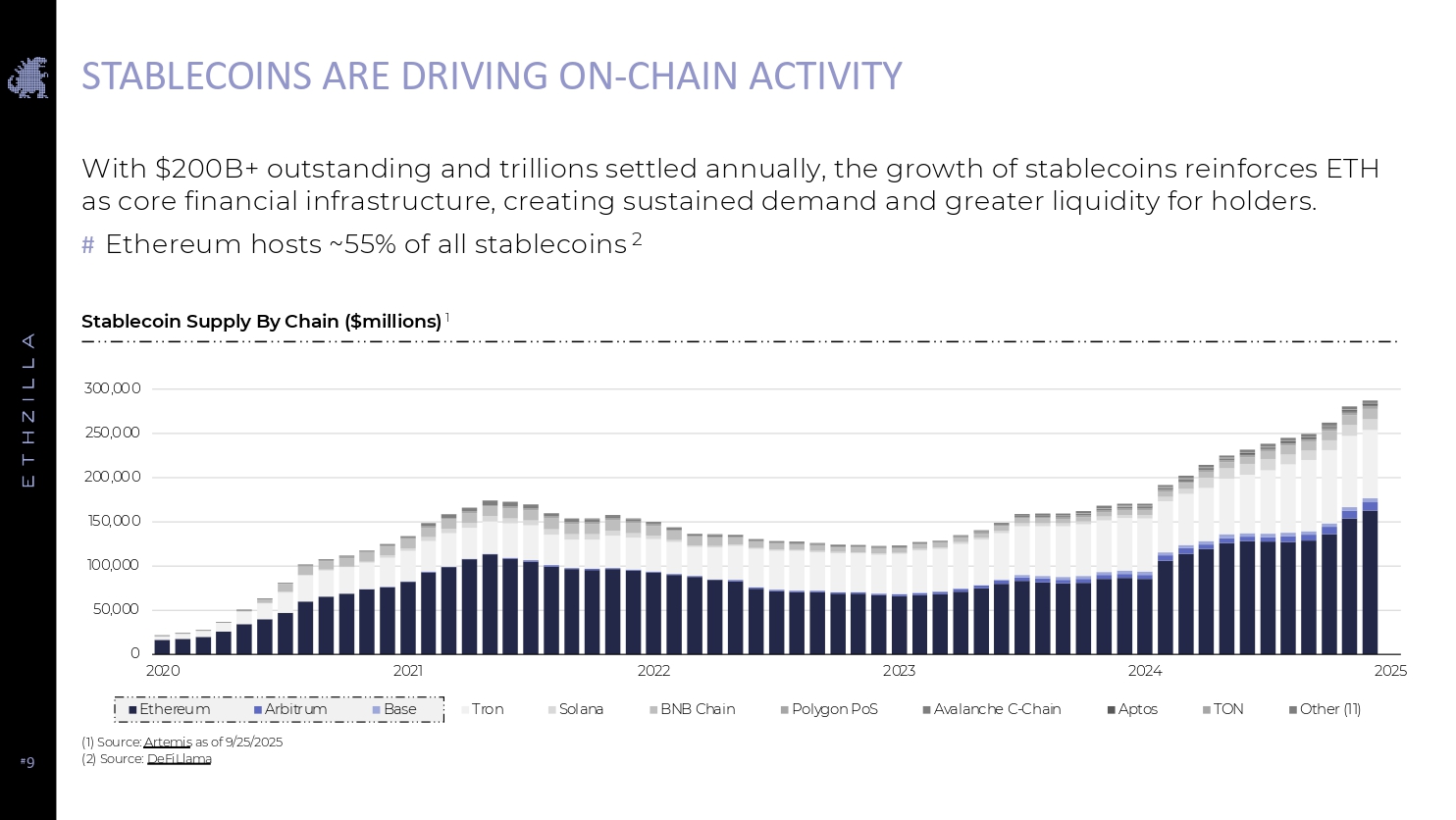

# 9 STABLECOINS ARE DRIVING ON - CHAIN ACTIVITY (1) Source: Artemis as of 9/25/2025 (2) Source: DeFiLlama With $200B+ outstanding and trillions settled annually, the growth of stablecoins reinforces ETH as core financial infrastructure, creating sustained demand and greater liquidity for holders. # Ethereum hosts ~55% of all stablecoins 2 Stablecoin Supply By Chain ($millions) 1 0 50,000 100,000 150,000 200,000 250,000 300,000 2020 2021 2022 2023 2024 2025 Millions Ethereum Arbitrum Base Tron Solana BNB Chain Polygon PoS Avalanche C-Chain Aptos TON Other (11)

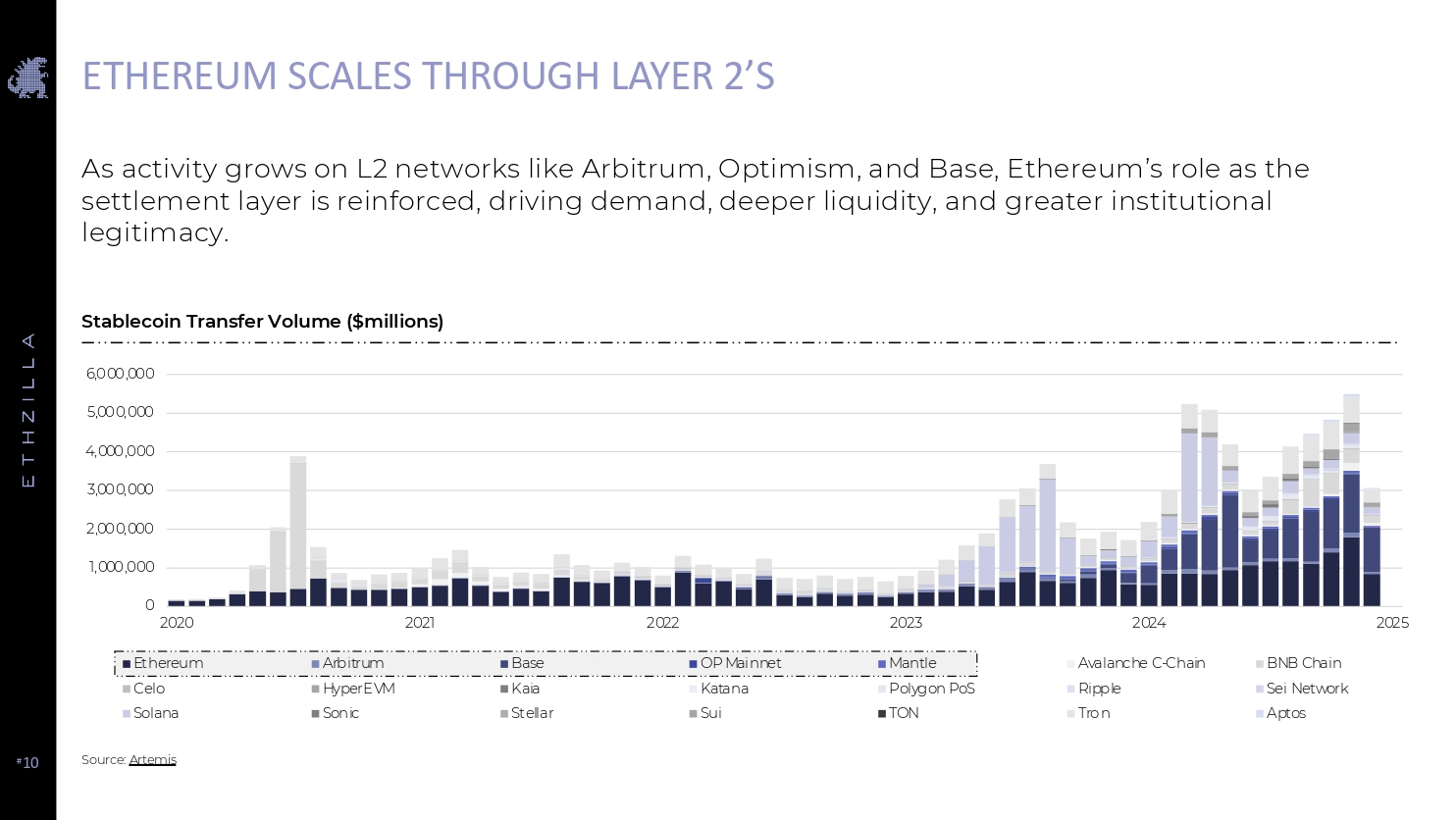

# 10 ETHEREUM SCALES THROUGH LAYER 2’S Source: Artemis As activity grows on L2 networks like Arbitrum , Optimism, and Base, Ethereum’s role as the settlement layer is reinforced, driving demand, deeper liquidity, and greater institutional legitimacy. Stablecoin Transfer Volume ($millions) 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 2020 2021 2022 2023 2024 2025 Ethereum Arbitrum Base OP Mainnet Mantle Avalanche C-Chain BNB Chain Celo HyperEVM Kaia Katana Polygon PoS Ripple Sei Network Solana Sonic Stellar Sui TON Tron Aptos

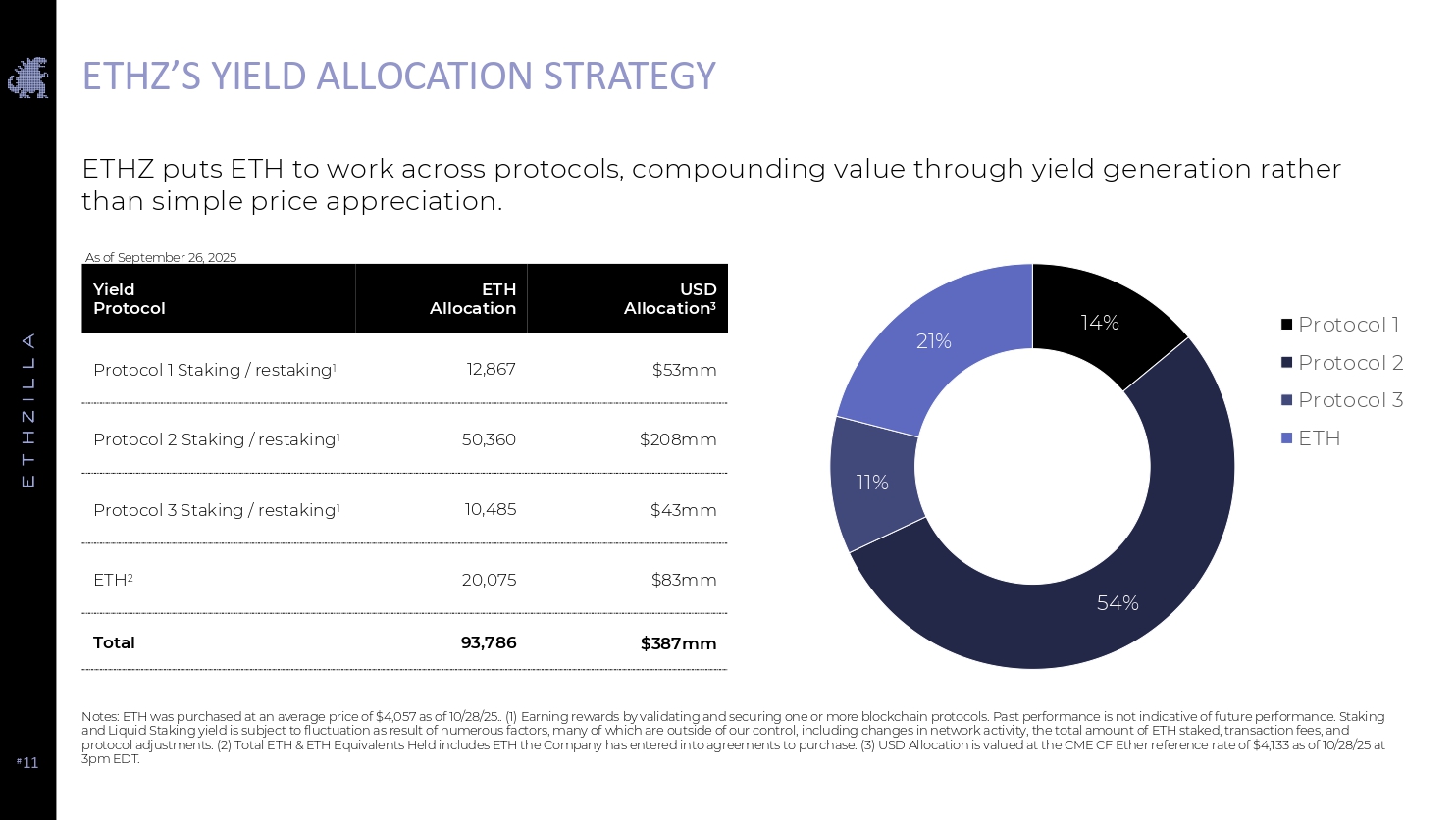

# 11 ETHZ’S YIELD ALLOCATION STRATEGY Notes: ETH was purchased at an average price of $4,057 as of 10/28/25.. (1) Earning rewards by validating and securing one or mo re blockchain protocols. Past performance is not indicative of future performance. Staking and Liquid Staking yield is subject to fluctuation as result of numerous factors, many of which are outside of our control, i ncl uding changes in network activity, the total amount of ETH staked, transaction fees, and protocol adjustments. (2) Total ETH & ETH Equivalents Held includes ETH the Company has entered into agreements to purchase. (3) USD Allocation is valued at the CME CF Ether reference rate of $4,133 as of 10/28/25 at 3pm EDT. ETHZ puts ETH to work across protocols, compounding value through yield generation rather than simple price appreciation. USD Allocation 3 ETH Allocation Yield Protocol $53mm 12,867 Protocol 1 Staking / restaking 1 $208mm 50,360 Protocol 2 Staking / restaking 1 $43mm 10,485 Protocol 3 Staking / restaking 1 $83mm 20,075 ETH 2 $387mm 93,786 Total 14% 54% 11% 21% Protocol 1 Protocol 2 Protocol 3 ETH As of September 26, 2025

TOKENIZATION

# 13 INSTITUTIONAL ADOPTION # Global Financial Institutional adoption is accelerating + BlackRock launched BUIDL tokenized fund + Galaxy Digital launched GalaxyOne + Franklin Templeton developed Benji Technology + JPMorgan developed Kinexys Blockchain # Regulatory Clarity through U.S. GENIUS Act and EU frameworks accelerating institutional adoption and regulation # Efficiency Gains: Instant Settlement, Fractional ownership, programmable yield distribution. # DeFi Integration: Tokenized Real - World Assets on L2s will be real collateral in the ETH Ecosystem Growth Drivers Tokenization is moving private and real - world assets on - chain, and we are seeing institutions are embracing the shift.

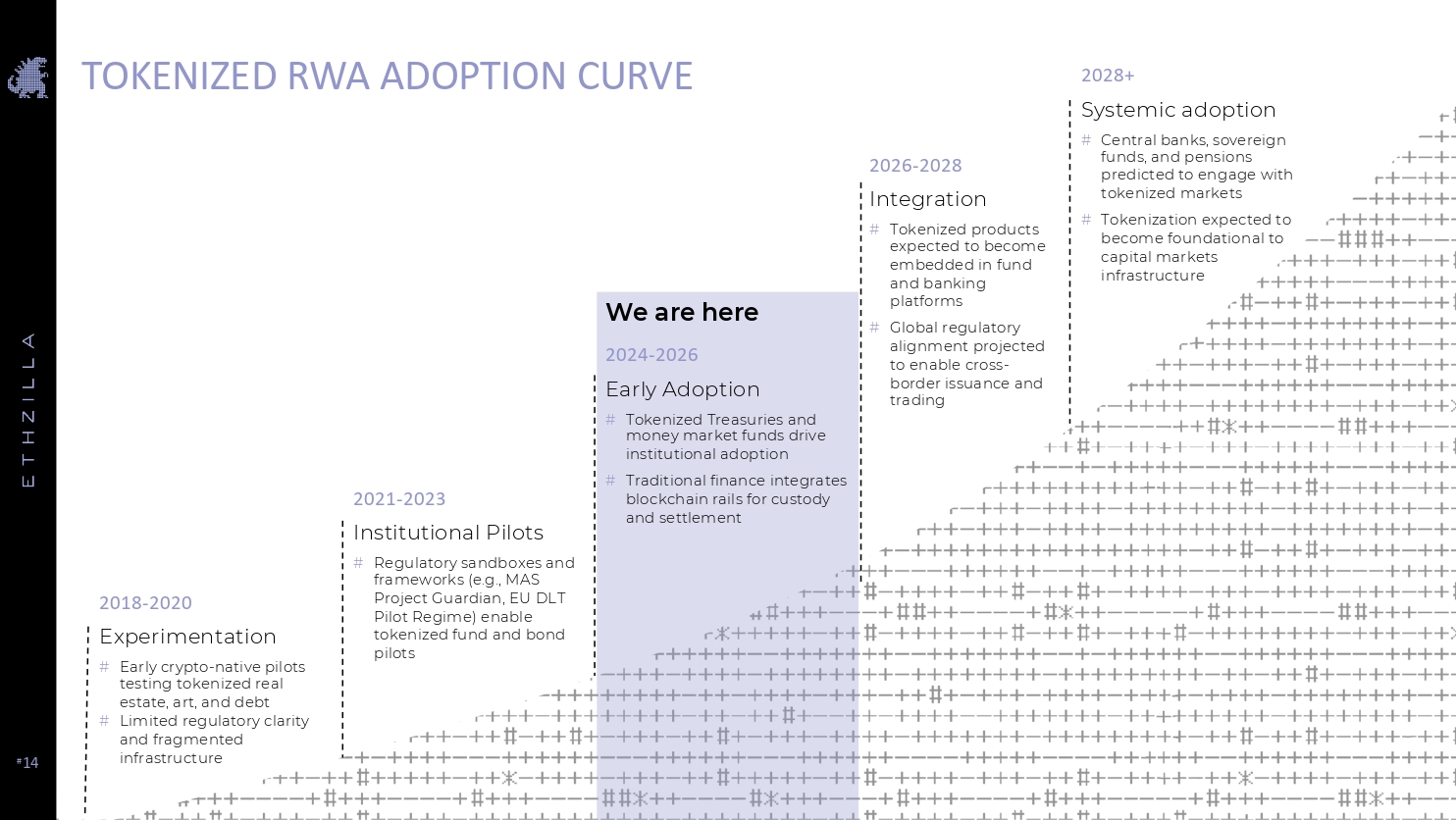

# 14 TOKENIZED RWA ADOPTION CURVE 2018 - 2020 Experimentation # Early crypto - native pilots testing tokenized real estate, art, and debt # Limited regulatory clarity and fragmented infrastructure 2021 - 2023 Institutional Pilots # Regulatory sandboxes and frameworks (e.g., MAS Project Guardian, EU DLT Pilot Regime) enable tokenized fund and bond pilots 2024 - 2026 Early Adoption # Tokenized Treasuries and money market funds drive institutional adoption # Traditional finance integrates blockchain rails for custody and settlement 2026 - 2028 Integration # Tokenized products expected to become embedded in fund and banking platforms # Global regulatory alignment projected to enable cross - border issuance and trading 2028+ Systemic adoption # Central banks, sovereign funds, and pensions predicted to engage with tokenized markets # Tokenization expected to become foundational to capital markets infrastructure We are here

# 15 ETHZILLA INVESTS IN LIQUIDITY.IO # ETHZilla is purchased 15% of parent company of Liquidity.io at a $100mm valuation # ETHZilla invested $5mm cash & issued $10mm of restricted ETHZ common shares to parent company of Liquidity.io # ETHZilla has exclusive right to list Ethereum L2 Tokens on the Exchange # ETHZilla to take one of three board seats atparent company of Liquidity.io # Right of first refusal (ROFR) to acquire additional equity in future funding rounds Investment Terms Strategic Rationale # Secures exclusive access to a regulated exchange, accelerating ETHZilla's tokenization + compliance strategy and establishing a competitive moat # Enables ETHZilla to leverage Liquidity.io’s ATS to convert future ETHZilla - issued tokenized RWAs into compliant, tradable instruments with both primary and secondary market liquidity. # Compliance distribution engine secured, providing bank - grade KYC/KYB, onboarding, and workflow automation, accelerating onboarding and enterprise adoption.

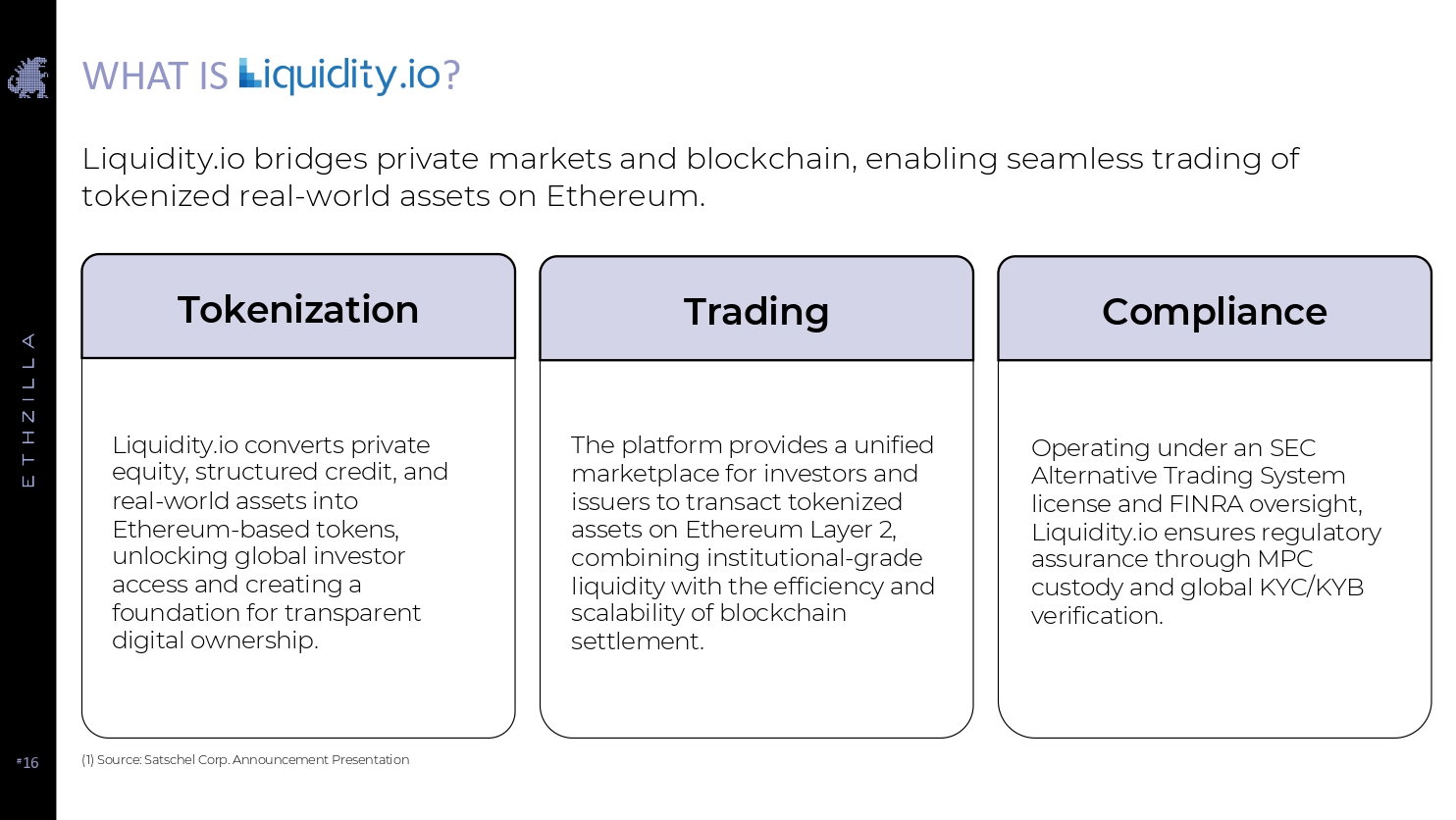

# 16 WHAT IS ? Liquidity.io bridges private markets and blockchain, enabling seamless trading of tokenized real - world assets on Ethereum. (1) Source: Satschel Corp. Announcement Presentation Liquidity.io converts private equity, structured credit, and real - world assets into Ethereum - based tokens, unlocking global investor access and creating a foundation for transparent digital ownership. Tokenization The platform provides a unified marketplace for investors and issuers to transact tokenized assets on Ethereum Layer 2, combining institutional - grade liquidity with the efficiency and scalability of blockchain settlement. Trading Operating under an SEC Alternative Trading System license and FINRA oversight, Liquidity.io ensures regulatory assurance through MPC custody and global KYC/KYB verification. Compliance

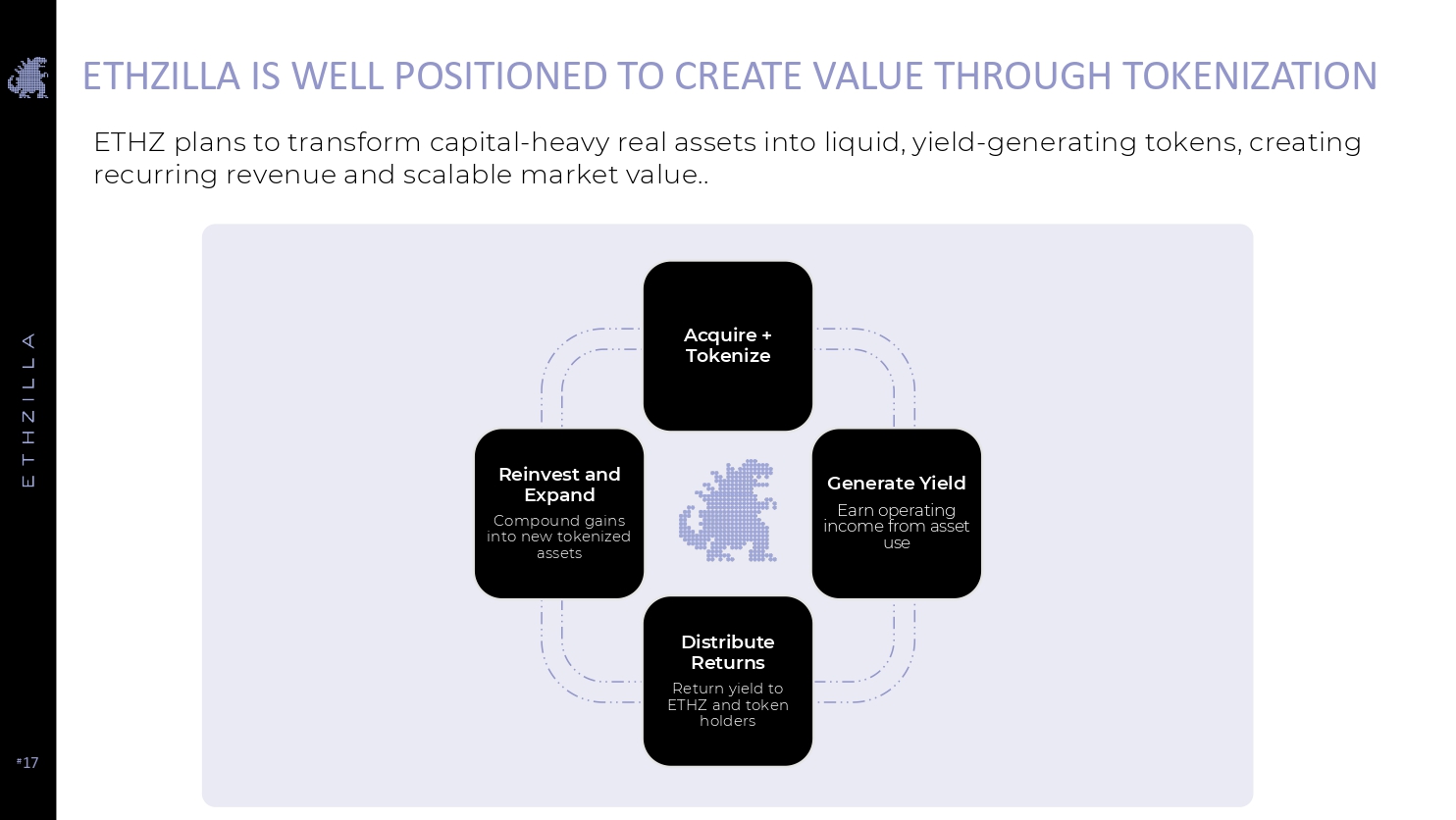

# 17 ETHZ plans to transform capital - heavy real assets into liquid, yield - generating tokens, creating recurring revenue and scalable market value.. ETHZILLA IS WELL POSITIONED TO CREATE VALUE THROUGH TOKENIZATION Acquire + Tokenize Distribute Returns Return yield to ETHZ and token holders Generate Yield Earn operating income from asset use Reinvest and Expand Compound gains into new tokenized assets

COMPELLING VALUATION

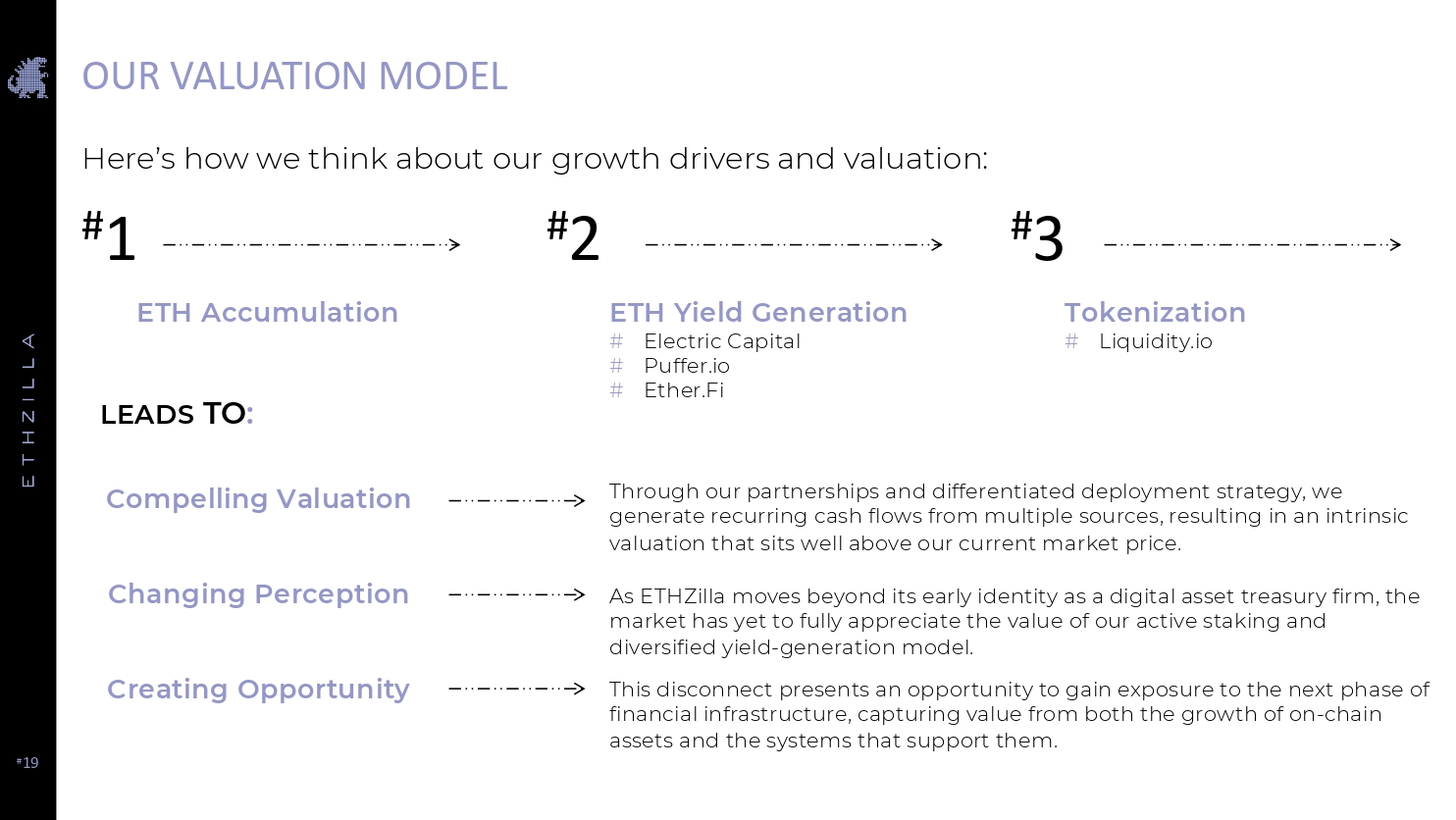

# 19 # 3 OUR VALUATION MODEL # 1 ETH Accumulation ETH Yield Generation # Electric Capital # Puffer.io # Ether.Fi Tokenization # Liquidity.io LEADS TO : Here’s how we think about our growth drivers and valuation: Through our partnerships and differentiated deployment strategy, we generate recurring cash flows from multiple sources, resulting in an intrinsic valuation that sits well above our current market price. As ETHZilla moves beyond its early identity as a digital asset treasury firm, the market has yet to fully appreciate the value of our active staking and diversified yield - generation model. This disconnect presents an opportunity to gain exposure to the next phase of financial infrastructure, capturing value from both the growth of on - chain assets and the systems that support them. Compelling Valuation Changing Perception Creating Opportunity # 2

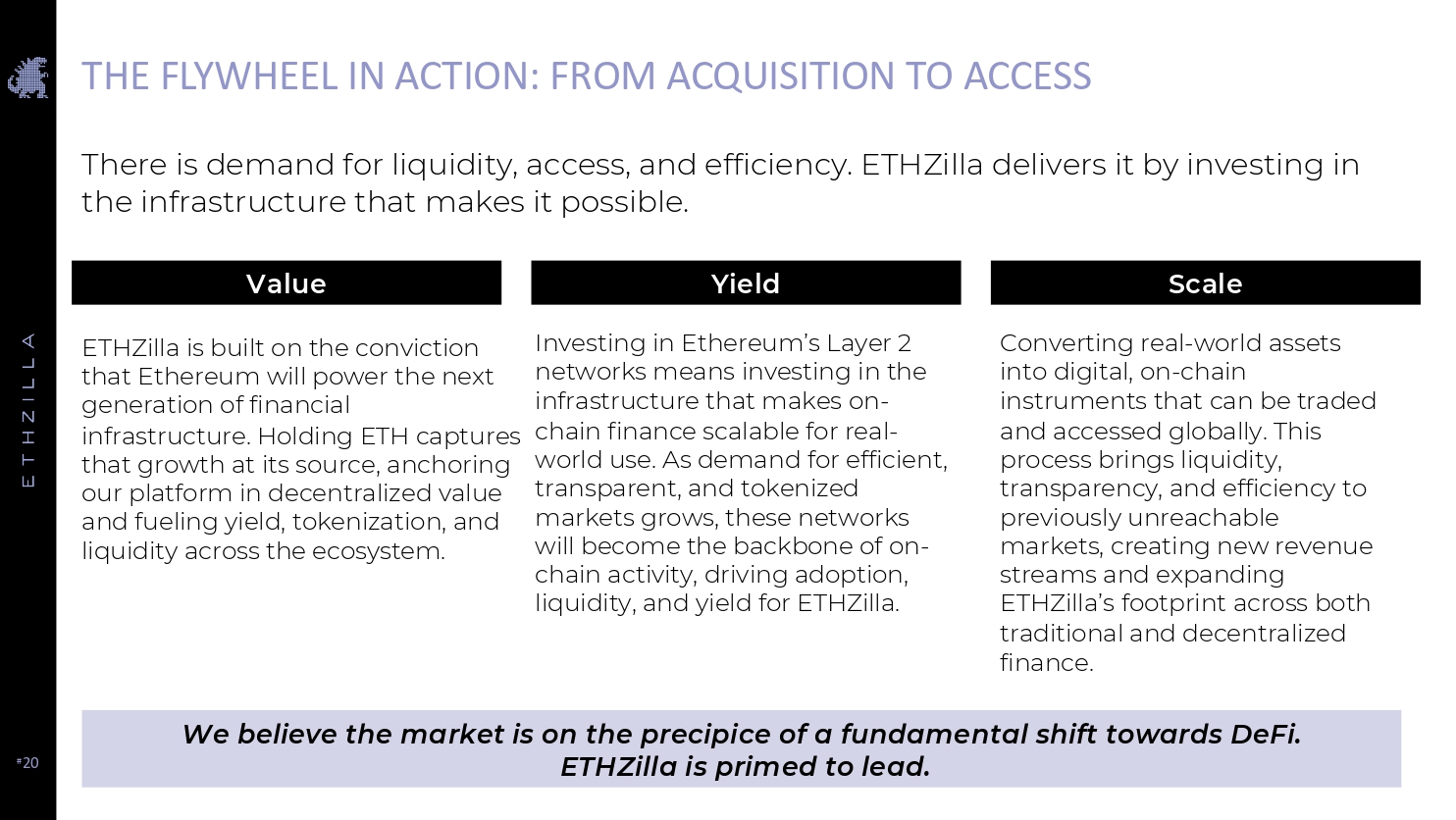

# 20 THE FLYWHEEL IN ACTION: FROM ACQUISITION TO ACCESS There is demand for liquidity, access, and efficiency. ETHZilla delivers it by investing in the infrastructure that makes it possible. ETHZilla is built on the conviction that Ethereum will power the next generation of financial infrastructure. Holding ETH captures that growth at its source, anchoring our platform in decentralized value and fueling yield, tokenization, and liquidity across the ecosystem. Investing in Ethereum’s Layer 2 networks means investing in the infrastructure that makes on - chain finance scalable for real - world use. As demand for efficient, transparent, and tokenized markets grows, these networks will become the backbone of on - chain activity, driving adoption, liquidity, and yield for ETHZilla. Converting real - world assets into digital, on - chain instruments that can be traded and accessed globally. This process brings liquidity, transparency, and efficiency to previously unreachable markets, creating new revenue streams and expanding ETHZilla’s footprint across both traditional and decentralized finance. We believe the market is on the precipice of a fundamental shift towards DeFi. ETHZilla is primed to lead. Value Scale Yield

THANK YOU